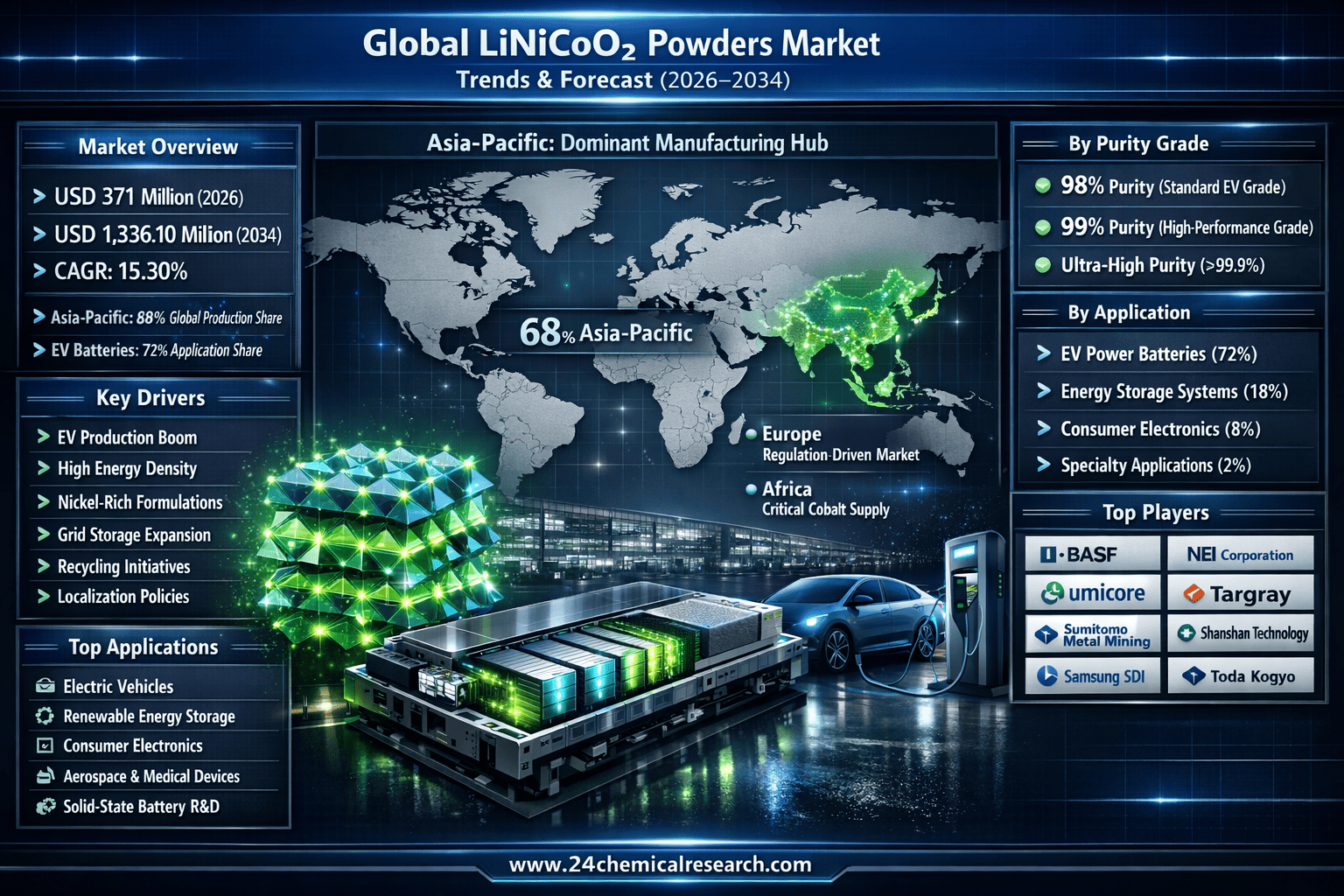

Global LiNiCoO₂ Powders Market to Reach USD 1,336.10 Million by 2034, Growing at a 15.30% CAGR

According to 24Chemical Research, global LiNiCoO₂ (Lithium Nickel Cobalt Oxide) powders market is projected to expand from USD 371 million in 2026 to USD 1,336.10 million by 2034, registering a strong CAGR of 15.30%. The surge is primarily driven by accelerating adoption of lithium-ion batteries across electric vehicles (EVs), energy storage systems, and consumer electronics.

LiNiCoO₂ cathode materials play a pivotal role in high-energy-density battery architectures, enabling extended EV driving ranges exceeding 300 miles. As global EV production scales rapidly, manufacturers are focusing on nickel-rich formulations and cobalt-reduction strategies to enhance performance while mitigating supply chain risks.

Regional Market Dynamics

Asia-Pacific dominates global production with a 68% share, supported by China’s gigafactories and advanced materials expertise in Japan and South Korea. Companies such as Toda Kogyo and vertically integrated suppliers across East Asia play a central role in scaling cathode output.

North America shows the fastest growth (13.11% CAGR), driven by domestic battery supply chain investments and localization strategies supported by the U.S. Inflation Reduction Act. Meanwhile, Europe benefits from strict sustainability mandates under the EU Battery Regulation, accelerating recycling infrastructure and circular economy initiatives.

Key Growth Drivers

EV power batteries (72% market share)

Nickel-rich cathode innovations (Ni >80%)

Solid-state battery compatibility advancements

Recycling systems targeting >95% metal recovery

Grid-scale renewable energy storage expansion

Market Challenges

The industry faces cobalt price volatility—averaging USD 32,500 per ton in 2023—and geopolitical risks linked to the Democratic Republic of Congo’s dominant cobalt supply. Technical challenges include high-voltage stability, oxygen release risks, and moisture sensitivity during processing.

Nevertheless, strategic investments, digitalized manufacturing, and direct OEM-cathode partnerships are reshaping the competitive landscape, ensuring sustained long-term growth.

Download FREE Sample Report:

https://www.24chemicalresearch.com/download-sample/284209/global-regional-linicoo-powders-for-lithium-battery-forecast-supply-dem-analysis-competitive-market-2025-2032-798

Get Full Report:

https://www.24chemicalresearch.com/reports/284209/global-regional-linicoo-powders-for-lithium-battery-forecast-supply-dem-analysis-competitive-market-2025-2032-798

About 24Chemical Research

Founded in 2015, 24Chemical Research delivers data-driven market intelligence across chemicals and advanced materials, serving over 30 Fortune 500 companies globally.

According to 24Chemical Research, global LiNiCoO₂ (Lithium Nickel Cobalt Oxide) powders market is projected to expand from USD 371 million in 2026 to USD 1,336.10 million by 2034, registering a strong CAGR of 15.30%. The surge is primarily driven by accelerating adoption of lithium-ion batteries across electric vehicles (EVs), energy storage systems, and consumer electronics.

LiNiCoO₂ cathode materials play a pivotal role in high-energy-density battery architectures, enabling extended EV driving ranges exceeding 300 miles. As global EV production scales rapidly, manufacturers are focusing on nickel-rich formulations and cobalt-reduction strategies to enhance performance while mitigating supply chain risks.

Regional Market Dynamics

Asia-Pacific dominates global production with a 68% share, supported by China’s gigafactories and advanced materials expertise in Japan and South Korea. Companies such as Toda Kogyo and vertically integrated suppliers across East Asia play a central role in scaling cathode output.

North America shows the fastest growth (13.11% CAGR), driven by domestic battery supply chain investments and localization strategies supported by the U.S. Inflation Reduction Act. Meanwhile, Europe benefits from strict sustainability mandates under the EU Battery Regulation, accelerating recycling infrastructure and circular economy initiatives.

Key Growth Drivers

EV power batteries (72% market share)

Nickel-rich cathode innovations (Ni >80%)

Solid-state battery compatibility advancements

Recycling systems targeting >95% metal recovery

Grid-scale renewable energy storage expansion

Market Challenges

The industry faces cobalt price volatility—averaging USD 32,500 per ton in 2023—and geopolitical risks linked to the Democratic Republic of Congo’s dominant cobalt supply. Technical challenges include high-voltage stability, oxygen release risks, and moisture sensitivity during processing.

Nevertheless, strategic investments, digitalized manufacturing, and direct OEM-cathode partnerships are reshaping the competitive landscape, ensuring sustained long-term growth.

Download FREE Sample Report:

https://www.24chemicalresearch.com/download-sample/284209/global-regional-linicoo-powders-for-lithium-battery-forecast-supply-dem-analysis-competitive-market-2025-2032-798

Get Full Report:

https://www.24chemicalresearch.com/reports/284209/global-regional-linicoo-powders-for-lithium-battery-forecast-supply-dem-analysis-competitive-market-2025-2032-798

About 24Chemical Research

Founded in 2015, 24Chemical Research delivers data-driven market intelligence across chemicals and advanced materials, serving over 30 Fortune 500 companies globally.

Global LiNiCoO₂ Powders Market to Reach USD 1,336.10 Million by 2034, Growing at a 15.30% CAGR

According to 24Chemical Research, global LiNiCoO₂ (Lithium Nickel Cobalt Oxide) powders market is projected to expand from USD 371 million in 2026 to USD 1,336.10 million by 2034, registering a strong CAGR of 15.30%. The surge is primarily driven by accelerating adoption of lithium-ion batteries across electric vehicles (EVs), energy storage systems, and consumer electronics.

LiNiCoO₂ cathode materials play a pivotal role in high-energy-density battery architectures, enabling extended EV driving ranges exceeding 300 miles. As global EV production scales rapidly, manufacturers are focusing on nickel-rich formulations and cobalt-reduction strategies to enhance performance while mitigating supply chain risks.

Regional Market Dynamics

Asia-Pacific dominates global production with a 68% share, supported by China’s gigafactories and advanced materials expertise in Japan and South Korea. Companies such as Toda Kogyo and vertically integrated suppliers across East Asia play a central role in scaling cathode output.

North America shows the fastest growth (13.11% CAGR), driven by domestic battery supply chain investments and localization strategies supported by the U.S. Inflation Reduction Act. Meanwhile, Europe benefits from strict sustainability mandates under the EU Battery Regulation, accelerating recycling infrastructure and circular economy initiatives.

Key Growth Drivers

EV power batteries (72% market share)

Nickel-rich cathode innovations (Ni >80%)

Solid-state battery compatibility advancements

Recycling systems targeting >95% metal recovery

Grid-scale renewable energy storage expansion

Market Challenges

The industry faces cobalt price volatility—averaging USD 32,500 per ton in 2023—and geopolitical risks linked to the Democratic Republic of Congo’s dominant cobalt supply. Technical challenges include high-voltage stability, oxygen release risks, and moisture sensitivity during processing.

Nevertheless, strategic investments, digitalized manufacturing, and direct OEM-cathode partnerships are reshaping the competitive landscape, ensuring sustained long-term growth.

📥 Download FREE Sample Report:

https://www.24chemicalresearch.com/download-sample/284209/global-regional-linicoo-powders-for-lithium-battery-forecast-supply-dem-analysis-competitive-market-2025-2032-798

🔗 Get Full Report:

https://www.24chemicalresearch.com/reports/284209/global-regional-linicoo-powders-for-lithium-battery-forecast-supply-dem-analysis-competitive-market-2025-2032-798

About 24Chemical Research

Founded in 2015, 24Chemical Research delivers data-driven market intelligence across chemicals and advanced materials, serving over 30 Fortune 500 companies globally.

0 Comments

·0 Shares

·106 Views

·0 Reviews