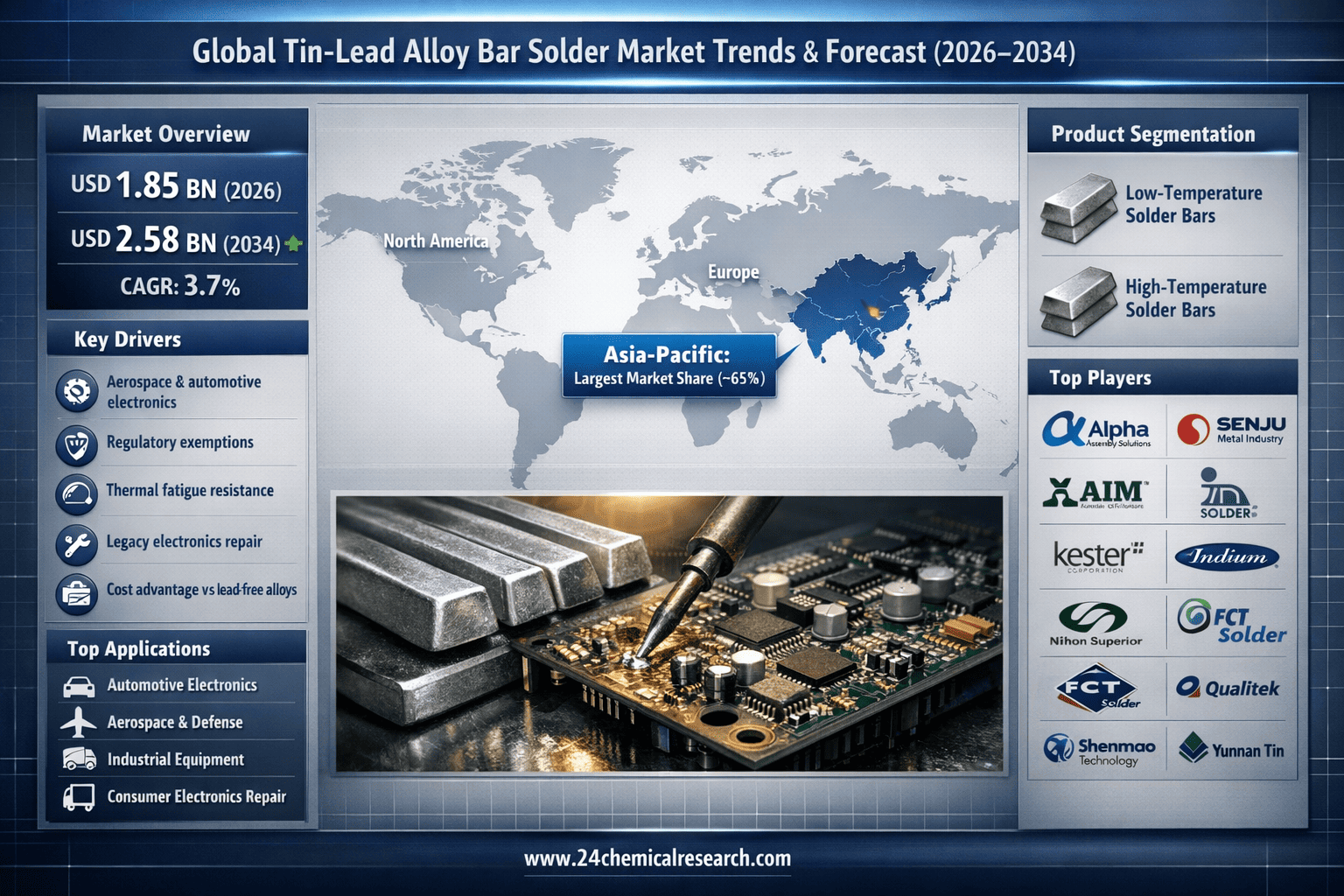

Global Tin-Lead Alloy Bar Solder Market to Reach USD 2.58 Billion by 2034, Led by High-Reliability Applications

According to 24Chemical Research, Global Tin-Lead Alloy Bar Solder Market was valued at USD 1.85 billion in 2026 and is projected to reach USD 2.58 billion by 2034, expanding at a CAGR of 3.7% during the forecast period.

Tin-lead alloy bar solder—most commonly formulated as Sn60/Pb40—remains a cornerstone material in electronics manufacturing due to its exceptional wettability, strong electrical conductivity, and superior thermal fatigue resistance. While global environmental regulations have accelerated the transition toward lead-free alternatives in consumer electronics, tin-lead solder continues to dominate high-reliability and safety-critical applications where performance consistency outweighs regulatory constraints.

Sustained demand is driven by aerospace, defense, automotive electronics, and industrial equipment, where regulatory exemptions allow continued use of tin-lead alloys. The automotive sector alone accounts for approximately 25% of global consumption, particularly in engine control units and safety systems requiring long-term reliability under extreme thermal cycling. Additionally, legacy system maintenance and repair provides a stable aftermarket demand, as industrial and telecom equipment manufactured prior to RoHS implementation requires original-specification solder materials.

Despite its advantages, the market faces challenges from stringent environmental regulations, rising compliance costs, and the electronics industry’s broader shift toward “green manufacturing.” However, opportunities are emerging through specialized, high-performance alloy formulations, automated soldering technologies, and growth in emerging markets across Southeast Asia, Africa, and South America, where cost efficiency remains a priority.

The market is moderately consolidated, with the top players accounting for nearly 60% of global share. Leading companies include Alpha Assembly Solutions, Senju Metal Industry, AIM Solder, Kester (ITW), Indium Corporation, Qualitek, Nihon Superior, Shenmao Technology, and Yunnan Tin, among others.

Get Full Report:

https://www.24chemicalresearch.com/reports/306460/tinlead-alloy-bar-solder-market

Download FREE Sample:

https://www.24chemicalresearch.com/download-sample/306460/tinlead-alloy-bar-solder-market

About 24Chemical Research

Founded in 2015, 24Chemical Research provides data-driven chemical and materials market intelligence to 30+ Fortune 500 companies, offering plant-level capacity tracking, real-time price monitoring, and techno-economic feasibility studies.

Contact:

International: +1 (332) 2424 294

Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

According to 24Chemical Research, Global Tin-Lead Alloy Bar Solder Market was valued at USD 1.85 billion in 2026 and is projected to reach USD 2.58 billion by 2034, expanding at a CAGR of 3.7% during the forecast period.

Tin-lead alloy bar solder—most commonly formulated as Sn60/Pb40—remains a cornerstone material in electronics manufacturing due to its exceptional wettability, strong electrical conductivity, and superior thermal fatigue resistance. While global environmental regulations have accelerated the transition toward lead-free alternatives in consumer electronics, tin-lead solder continues to dominate high-reliability and safety-critical applications where performance consistency outweighs regulatory constraints.

Sustained demand is driven by aerospace, defense, automotive electronics, and industrial equipment, where regulatory exemptions allow continued use of tin-lead alloys. The automotive sector alone accounts for approximately 25% of global consumption, particularly in engine control units and safety systems requiring long-term reliability under extreme thermal cycling. Additionally, legacy system maintenance and repair provides a stable aftermarket demand, as industrial and telecom equipment manufactured prior to RoHS implementation requires original-specification solder materials.

Despite its advantages, the market faces challenges from stringent environmental regulations, rising compliance costs, and the electronics industry’s broader shift toward “green manufacturing.” However, opportunities are emerging through specialized, high-performance alloy formulations, automated soldering technologies, and growth in emerging markets across Southeast Asia, Africa, and South America, where cost efficiency remains a priority.

The market is moderately consolidated, with the top players accounting for nearly 60% of global share. Leading companies include Alpha Assembly Solutions, Senju Metal Industry, AIM Solder, Kester (ITW), Indium Corporation, Qualitek, Nihon Superior, Shenmao Technology, and Yunnan Tin, among others.

Get Full Report:

https://www.24chemicalresearch.com/reports/306460/tinlead-alloy-bar-solder-market

Download FREE Sample:

https://www.24chemicalresearch.com/download-sample/306460/tinlead-alloy-bar-solder-market

About 24Chemical Research

Founded in 2015, 24Chemical Research provides data-driven chemical and materials market intelligence to 30+ Fortune 500 companies, offering plant-level capacity tracking, real-time price monitoring, and techno-economic feasibility studies.

Contact:

International: +1 (332) 2424 294

Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Global Tin-Lead Alloy Bar Solder Market to Reach USD 2.58 Billion by 2034, Led by High-Reliability Applications

According to 24Chemical Research, Global Tin-Lead Alloy Bar Solder Market was valued at USD 1.85 billion in 2026 and is projected to reach USD 2.58 billion by 2034, expanding at a CAGR of 3.7% during the forecast period.

Tin-lead alloy bar solder—most commonly formulated as Sn60/Pb40—remains a cornerstone material in electronics manufacturing due to its exceptional wettability, strong electrical conductivity, and superior thermal fatigue resistance. While global environmental regulations have accelerated the transition toward lead-free alternatives in consumer electronics, tin-lead solder continues to dominate high-reliability and safety-critical applications where performance consistency outweighs regulatory constraints.

Sustained demand is driven by aerospace, defense, automotive electronics, and industrial equipment, where regulatory exemptions allow continued use of tin-lead alloys. The automotive sector alone accounts for approximately 25% of global consumption, particularly in engine control units and safety systems requiring long-term reliability under extreme thermal cycling. Additionally, legacy system maintenance and repair provides a stable aftermarket demand, as industrial and telecom equipment manufactured prior to RoHS implementation requires original-specification solder materials.

Despite its advantages, the market faces challenges from stringent environmental regulations, rising compliance costs, and the electronics industry’s broader shift toward “green manufacturing.” However, opportunities are emerging through specialized, high-performance alloy formulations, automated soldering technologies, and growth in emerging markets across Southeast Asia, Africa, and South America, where cost efficiency remains a priority.

The market is moderately consolidated, with the top players accounting for nearly 60% of global share. Leading companies include Alpha Assembly Solutions, Senju Metal Industry, AIM Solder, Kester (ITW), Indium Corporation, Qualitek, Nihon Superior, Shenmao Technology, and Yunnan Tin, among others.

Get Full Report:

https://www.24chemicalresearch.com/reports/306460/tinlead-alloy-bar-solder-market

Download FREE Sample:

https://www.24chemicalresearch.com/download-sample/306460/tinlead-alloy-bar-solder-market

About 24Chemical Research

Founded in 2015, 24Chemical Research provides data-driven chemical and materials market intelligence to 30+ Fortune 500 companies, offering plant-level capacity tracking, real-time price monitoring, and techno-economic feasibility studies.

Contact:

International: +1 (332) 2424 294

Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

0 Reacties

·0 aandelen

·89 Views

·0 voorbeeld