A Strategic Guide to Choosing the Right Mining Management Software

One wrong software decision can slow down an entire mine for years.

Mining is not a small operation. It involves heavy machinery, complex supply chains, strict safety rules, environmental responsibilities, and constant cost pressure. When systems are disconnected or outdated, mistakes multiply. Production delays happen. Equipment fails without warning. Reports become unreliable. Teams lose visibility.

This is where mining industry software becomes critical. The right system brings clarity, control, and coordination across operations. The wrong one creates confusion and wasted investment.

This guide will help you understand how to choose wisely.

Understanding Your Operational Needs Before Selecting Any System

Before looking at features or vendors, you must first understand your own operation. Every mine is different. Surface mining, underground mining, metal extraction, coal operations all have different workflows and challenges. Choosing software without internal clarity leads to poor results.

Analyze Your Current Operational Bottlenecks

Start by identifying where delays, errors, or inefficiencies occur most often. Is equipment downtime increasing. Are maintenance records scattered. Is inventory tracking inaccurate. Understanding pain points helps define what your mining industry software must solve. Without this clarity, you may invest in tools that do not address your core issues.

Identify Data Gaps Across Departments

Many mining companies struggle with disconnected data. Production teams use one system. Finance uses another. Maintenance records live somewhere else. This lack of integration creates blind spots. Evaluate where information breaks down. The right system should unify data so leaders can make decisions with confidence instead of assumptions.

Evaluate Compliance and Safety Requirements

Mining operations face strict regulatory requirements. Environmental monitoring, worker safety reporting, and equipment inspections must be documented accurately. Any mining industry software you consider should support compliance tracking and reporting. Failing to evaluate this early can lead to costly legal consequences later.

Assess Scalability for Future Expansion

Mines evolve. Production increases. New sites open. Regulations change. Your system must grow with you. During selection, ask whether the platform can handle higher data volumes, additional users, and expanded operational complexity. Scalability ensures your investment remains valuable for years.

Determine Integration with Existing Systems

Most mines already use accounting tools, fleet management systems, or supply chain software. Replacing everything at once is rarely realistic. Instead, your new solution should integrate smoothly. Strong integration prevents duplication of work and maintains operational continuity.

Define Clear Success Metrics

Before purchasing anything, define what success looks like. Is it reduced downtime. Improved production accuracy. Better cost control. Clear metrics allow you to measure the return on investment once the system is live. Without defined goals, it becomes difficult to judge effectiveness.

Evaluating Core Features That Truly Matter

Once you understand your internal needs, you can focus on evaluating features. Not all features are equally valuable. Some are essential while others are unnecessary for your operation.

Real Time Production Monitoring

A strong mining industry software platform should provide real time visibility into production data. Managers should see output levels, equipment performance, and material movement instantly. Real time data reduces reaction time and helps prevent small problems from becoming major disruptions.

Predictive Maintenance Capabilities

Unexpected equipment failure is one of the most expensive problems in mining. Predictive maintenance tools analyze patterns and alert teams before breakdowns occur. This improves equipment lifespan and reduces costly downtime. When evaluating systems, ensure predictive capabilities are practical and easy to interpret.

Inventory and Supply Chain Management

Mining operations rely heavily on spare parts and raw materials. Poor inventory tracking leads to delays and excess stock costs. A good system should track inventory levels, automate reordering, and provide accurate reporting. This ensures smooth operations and cost control.

Safety and Incident Reporting Tools

Worker safety must always come first. Effective systems allow digital incident reporting, risk tracking, and compliance documentation. Easy reporting encourages transparency and faster corrective action. Software should simplify safety management rather than complicate it.

Data Analytics and Reporting Dashboards

Leadership teams require clear insights. Advanced analytics help transform raw data into meaningful information. Look for dashboards that are customizable and easy to understand. Complex interfaces often discourage usage, reducing the value of the platform.

Mobile Accessibility for Field Teams

Mining is not an office based industry. Supervisors and technicians work on site. Mobile access allows them to update records, review tasks, and access information directly from the field. This improves efficiency and reduces delays caused by paperwork or communication gaps.

Considering Implementation and Development Approach

Even the best system can fail if implementation is poorly handled. Choosing the right development strategy is just as important as choosing features.

Off The Shelf Versus Custom Built Solutions

Some companies choose ready made platforms. Others invest in tailored solutions through software development teams. Off the shelf systems are faster to deploy but may not fit unique processes. Custom solutions align closely with operational workflows but require more planning and time.

Implementation Timeline and Resource Planning

Implementation requires planning. Data migration, employee training, and system configuration all take time. Rushing this phase often leads to confusion and resistance from staff. Build a realistic timeline and allocate internal resources to support the transition.

Employee Training and Change Management

Resistance to change is common in mining environments. Workers may hesitate to adopt new digital tools. Clear communication, proper training, and leadership support are essential. When employees understand how the system benefits their daily tasks, adoption improves significantly.

Data Security and System Reliability

Mining companies handle sensitive operational and financial data. Strong security protocols are essential. Evaluate encryption standards, user access controls, and backup systems. System downtime can halt operations, so reliability must be thoroughly assessed.

Vendor Support and Long Term Partnership

Software is not a one time purchase. Ongoing updates and support are necessary. Choose providers that offer continuous technical support and improvements. A strong partnership ensures your system evolves alongside your business needs.

Total Cost of Ownership

Initial purchase price is only part of the cost. Consider maintenance fees, upgrades, training expenses, and infrastructure requirements. A lower upfront cost may lead to higher long term expenses. Evaluate total cost carefully to avoid budget surprises.

Measuring Long Term Value and Strategic Impact

The final step in choosing mining industry software is understanding its broader impact on your organization. Beyond daily operations, the right system can shape long term strategy.

Improved Operational Efficiency

When data flows smoothly and teams are aligned, productivity increases. Automated processes reduce manual errors and save time. Over months and years, these improvements translate into significant financial gains.

Enhanced Decision Making Through Data

Leaders often rely on reports that are days or weeks old. Real time analytics allow proactive decision making. Instead of reacting to problems, management can anticipate challenges and act strategically.

Strengthened Regulatory Compliance

Accurate digital records simplify audits and regulatory inspections. Automated reporting reduces the risk of missing documentation. This protects the organization from penalties and reputational damage.

Greater Workforce Accountability

Clear task tracking and transparent reporting systems increase accountability. Employees understand expectations and performance metrics. This builds a culture of responsibility and continuous improvement.

Competitive Advantage in a Digital Industry

The mining sector is becoming more technology driven. Companies that adopt strong digital systems gain an edge. Efficient operations and data driven insights create resilience in volatile markets.

Foundation for Future Innovation

Advanced technologies such as artificial intelligence and automation require strong digital infrastructure. Selecting the right mining industry software today prepares your operation for future innovation and smarter systems tomorrow.

Conclusion

Choosing the right mining management system is not simply a technical decision. It is a strategic investment that affects productivity, safety, compliance, and profitability. By carefully analyzing operational needs, evaluating meaningful features, planning implementation wisely, and focusing on long term value, mining companies can make informed decisions.

The right mining industry software supports growth, reduces risk, and strengthens operational control. Take time to assess thoroughly before committing. A thoughtful approach today can prevent years of operational frustration tomorrow.

FAQs

What is mining industry software used for

Mining industry software helps manage production tracking, equipment maintenance, safety reporting, inventory control, and data analysis. It centralizes information so mining operations can run efficiently and make informed decisions.

Should mining companies choose custom or ready made solutions

The choice depends on operational complexity. Custom solutions developed through professional software development teams provide flexibility. Ready made systems are quicker to implement but may not perfectly match specific workflows.

How long does implementation typically take

Implementation timelines vary based on company size and system complexity. Small operations may complete the process in a few months, while larger enterprises may require extended planning and phased deployment.

Can mining software improve safety

Yes. Digital reporting tools, compliance tracking, and automated monitoring systems enhance transparency and reduce the likelihood of accidents or missed inspections.

How do companies measure return on investment

Return on investment can be measured through reduced downtime, improved production accuracy, lower maintenance costs, and better compliance management over time.

Catégories

Lire la suite

The knee high style from is classic and timeless with a pointed toe and black or tan leather composition. It looks perfect with jeans, dresses, but the best part is undoubtedly the comfort. The first thing to pop out of A small of a narrow side house that she bought on a flight to the UK. She had been journaling recently about wanting more trinkets. The mini dress was a go to silhouette for...

Parents often face the important decision of whether to hire a babysitter or a nanny for their child’s care. Each option offers unique benefits and considerations, and the right choice depends on a family’s schedule, budget, and childcare needs. Many families in Dubai turn to a Babysitting Service in Dubai at Home to connect with trained professionals, ensuring that whichever option...

Smart Wearables Market, valued at a robust US$ 19,800 million in 2024, is on a trajectory of remarkable expansion, projected to reach US$ 45,060 million by 2032. This growth, representing a compound annual growth rate (CAGR) of 12.8%, is detailed in a comprehensive new report published by Semiconductor Insight. The study highlights the transformative role these connected devices play in...

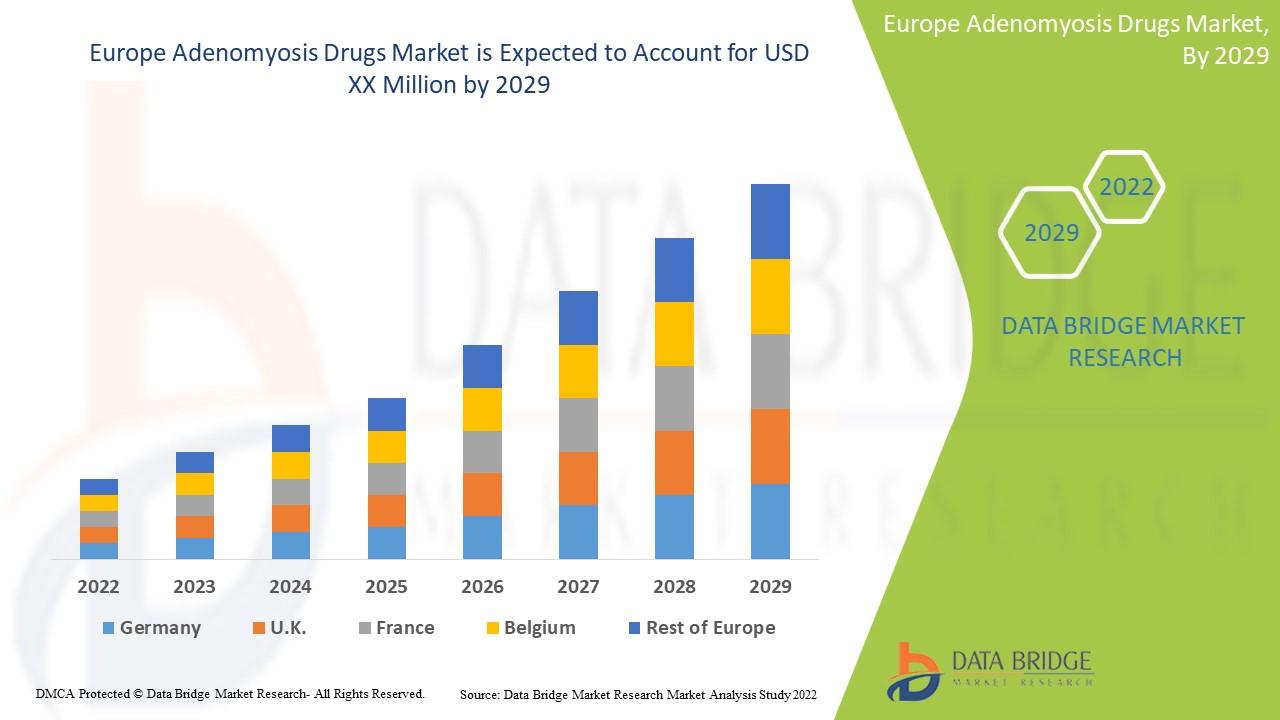

"Executive Summary Europe Adenomyosis Drugs Market Size and Share Analysis Report CAGR Value Europe adenomyosis drugs market is supportive and aims to reduce the progression of the disease. Data Bridge Market Research analyses that the Europe adenomyosis drugs market will grow at a CAGR of 5.6% during the forecast period of 2022 to 2029. Europe Adenomyosis Drugs...

"Executive Summary Blind Spot Solutions Market Opportunities by Size and Share CAGR Value The Global Blind Spot Solutions Market size was valued at USD 12.41 billion in 2024 and is expected to reach USD 25.69 billion by 2032, at a CAGR of 9.52% during the forecast period Blind Spot Solutions Market research report is a verified and consistent source of...