Pet Food Ingredients Market Size, Share, Trends, Key Drivers, Demand and Opportunity Analysis

"Executive Summary Pet Food Ingredients Market Size, Share, and Competitive Landscape

1. Introduction

In recent years, the Pet Food Ingredients Market has evolved from a niche specialty sector into a dynamic, high-growth segment of the global animal-nutrition and pet care industries. As pet ownership rises globally and pet parents increasingly view their companions as family members, demand for quality, safe, and functional pet nutrition is intensifying. Ingredients that contribute to health, wellness, digestibility, and sustainability are thus becoming ever more crucial.

This market now plays a significant role in the global economy: ingredient manufacturers supply proteins, vitamins, minerals, additives, probiotics, and other functional compounds not only to pet-food companies but also to ingredient formulators and feed-additive firms. Its importance stems from the upstream influence it exerts on cost structures, product differentiation, and regulatory compliance across the pet food chain.

Looking ahead, the pet food ingredients market is projected to grow at a robust compound annual growth rate (CAGR) in the range of 6 % to 8 % over the next 5–10 years, depending on region and segment. This growth is being driven by rising disposable incomes, urbanization, the humanization of pets, and increased interest in specialized and premium pet nutrition. In addition, innovation in novel proteins, clean-label ingredients, and sustainability-linked inputs contributes to the market’s forward momentum.

Get strategic knowledge, trends, and forecasts with our Pet Food Ingredients Market. Full report available for download:

https://www.databridgemarketresearch.com/reports/global-pet-food-ingredients-market

2. Market Overview

Scope and Size

The Pet Food Ingredients Market encompasses all raw and processed components incorporated into pet food products. These include macro-nutrients (proteins, fats, carbohydrates), micronutrients (vitamins, minerals, trace elements), functional additives (prebiotics, probiotics, enzymes, antioxidants), flavoring agents, preservatives, texturants, and specialty extracts (e.g. botanical, omega-3, collagen). The market also overlaps with feed-grade ingredients and functional feed additives, though it is distinguished by the stricter safety, regulatory, and nutritional specifications required for companion animals versus livestock.

In terms of market size, recent estimates suggest the global pet food ingredients market may be worth between USD 10 billion and USD 15 billion annually (as of 2024) and is expected to reach USD 18 billion to USD 22 billion by the end of the decade, depending on growth assumptions and commodity cost pressures.

Historical Trends and Current Positioning

Historically, the market was dominated by conventional protein sources (animal-meal, poultry by-products, fish meal) and vitamin-mineral premixes. Over time, as consumer expectations evolved, the share of functional ingredients, probiotics, novel proteins (e.g. insect, algae, single-cell proteins), and clean-label inputs has steadily risen. In many mature markets, premium and super-premium pet foods, using high-quality, differentiated ingredients, now command a large share of revenue, pushing up ingredient complexity.

Currently, the market is in a transitional phase. Traditional bulk ingredients still dominate in mass-market formulations, but niche and value-added ingredients are gaining faster traction. The supply chains are becoming more fragmented with specialist ingredient players entering. Meanwhile, regulatory scrutiny over safety, labeling, and contaminants has tightened, raising the bar for ingredient suppliers.

Demand-Supply Dynamics

On the demand side, pet owners’ willingness to pay is increasing, especially for premium, natural, and health-oriented formulations. This leads to higher ingredient costs and margin expansion opportunities for suppliers. Also, as new pet food formats emerge—e.g. freeze-dried, raw, frozen, fresh meals—the demand for specialized ingredients (stabilizers, encapsulants, shelf-life enhancers) rises.

On the supply side, ingredient manufacturers must manage volatility in raw-material costs (e.g. protein sources, oils, botanical extracts). Supply-chain disruptions (weather, geopolitical tension, transport logistics) can ripple through the value chain. Achieving consistent quality and regulatory compliance across geographies is another key supply-side challenge. As demand for alternative proteins grows, new-scale upstream production processes and fermentation/biotechnology capacities become critical.

In essence, the market is balancing between the pressure to lower input costs and the need to deliver higher-quality, differentiated ingredients that justify premium pricing.

3. Key Market Drivers

Several interrelated drivers are fueling growth in the pet food ingredients market:

3.1 Humanization of Pets & Premiumization

Consumers increasingly treat their pets as family members and seek high-quality nutrition comparable to human standards. This “pet humanization” trend pushes demand for premium, clean-label, functional, and tailored pet food, requiring more sophisticated ingredient mixes.

3.2 Growth of Novel and Alternative Protein Sources

As traditional protein sources face sustainability, cost, and supply constraints, manufacturers are exploring novel proteins—such as insect-based meals, algae proteins, single-cell proteins, and cultured cell-derived ingredients. These alternatives appeal to environmentally conscious pet owners and offer differentiation in the market.

3.3 Functional & Wellness Ingredients

Ingredients that contribute to gut health (prebiotics, probiotics), skin and coat (omega-3 fatty acids, collagen), joint health (glucosamine, chondroitin), antioxidants, and immunity are increasingly in demand. The rising interest in holistic pet wellness supports uptake of functional ingredients.

3.4 Regulatory Focus and Stricter Safety Standards

Regulatory agencies in many countries now require tighter control over contaminants (e.g. mycotoxins, heavy metals), labeling transparency (ingredient origin, inclusion levels), and novel ingredient approval. Ingredient suppliers that can ensure safety, traceability, and certification gain competitive advantages.

3.5 Advances in Ingredient Processing Technologies

Technological innovations—such as microencapsulation, enzyme-immobilization, extrusion technologies, fermentation, precision extraction, and nano-formulations—enable more bioavailable, stable, and targeted ingredients. These processes help extend shelf life, reduce wastage, and improve mixing efficacy.

3.6 Strategic Investments, Collaborations & M&A

Large pet food companies and ingredient firms are investing heavily in R&D, acquiring niche ingredient startups, and forming alliances to secure supply chains. These deals help firms expand their portfolios, achieve scale, and accelerate innovation.

3.7 Sustainability & Circular Economy Pressures

Consumers and regulators are increasingly concerned about environmental impact, carbon footprint, and sustainable sourcing. Ingredients derived from by-products, upcycled waste streams, or sustainable farming practices are increasingly attractive. This green driver nudges suppliers to innovate with eco-conscious ingredients.

4. Market Challenges

While the growth prospects are promising, the pet food ingredients market faces several headwinds and operational risks:

4.1 Regulatory Hurdles & Approval Delays

Each country has distinct regulatory regimes for pet food ingredients. Gaining approval for novel proteins or botanicals can be time-consuming and costly. Import/export restrictions and differences in allowable levels of additives add complexity.

4.2 Raw Material Volatility & Supply-chain Risks

Prices of proteins, oils, minerals, botanicals, and other raw materials are subject to fluctuations driven by weather, trade policies, crop yields, feedstock availability, and geopolitical events. Supply disruptions or raw-material shortages can squeeze margins.

4.3 Intensifying Competition & Margin Pressures

As more companies enter the ingredient space, competition intensifies, particularly in commoditized ingredient categories. Price pressures may erode margins, especially for lower-differentiation ingredients.

4.4 Technical & Formulation Challenges

Some functional ingredients may interfere with taste, texture, or stability of finished pet food. Ensuring compatibility, palatability, shelf stability, and bioavailability across different pet food matrices is complex. Ingredient suppliers must invest in application support and formulation services.

4.5 Consumer Skepticism & Safety Issues

Consumers expect transparency, “clean” ingredient sourcing, and safety assurances. Any contamination or recall event—whether for ingredients or finished pet food—can severely damage brand reputation and trust. Suppliers must maintain rigorous quality controls and traceability systems.

4.6 Entry Barriers for New Players

High capital investment is often required for specialized processing, regulatory compliance, certification, and R&D. This acts as a barrier to entry, particularly in more regulated markets.

5. Market Segmentation

Here is how the pet food ingredients market can be segmented, along with insights into growth segments:

By Type / Category

Proteins & amino acids (animal proteins, plant proteins, insect proteins, single-cell proteins)

Fats, oils & fatty acids (animal fats, fish oil, vegetable oils, omega-3/6 supplements)

Carbohydrates & fibers (starches, cellulose, prebiotic fibers)

Vitamins & minerals / premixes

Functional & specialty additives (probiotics, enzymes, antioxidants, botanicals, flavoring agents, stabilizers)

Texturants, binders & processing aids

Among these, functional & specialty additives and novel proteins (insect, algae, single-cell) are currently among the fastest-growing segments, due to premiumization and demand for differentiation.

By Application / Use Case

Dry pet food (kibble, extruded)

Wet / canned pet food

Semi-moist / soft pet food

Frozen / fresh / raw pet food

Treats, chews & supplements

Dry and wet foods remain the largest application segments in terms of volume. However, the fastest growth is often seen in fresh/frozen/raw formulations and premium treats / supplements, which demand higher-value ingredients and more innovation.

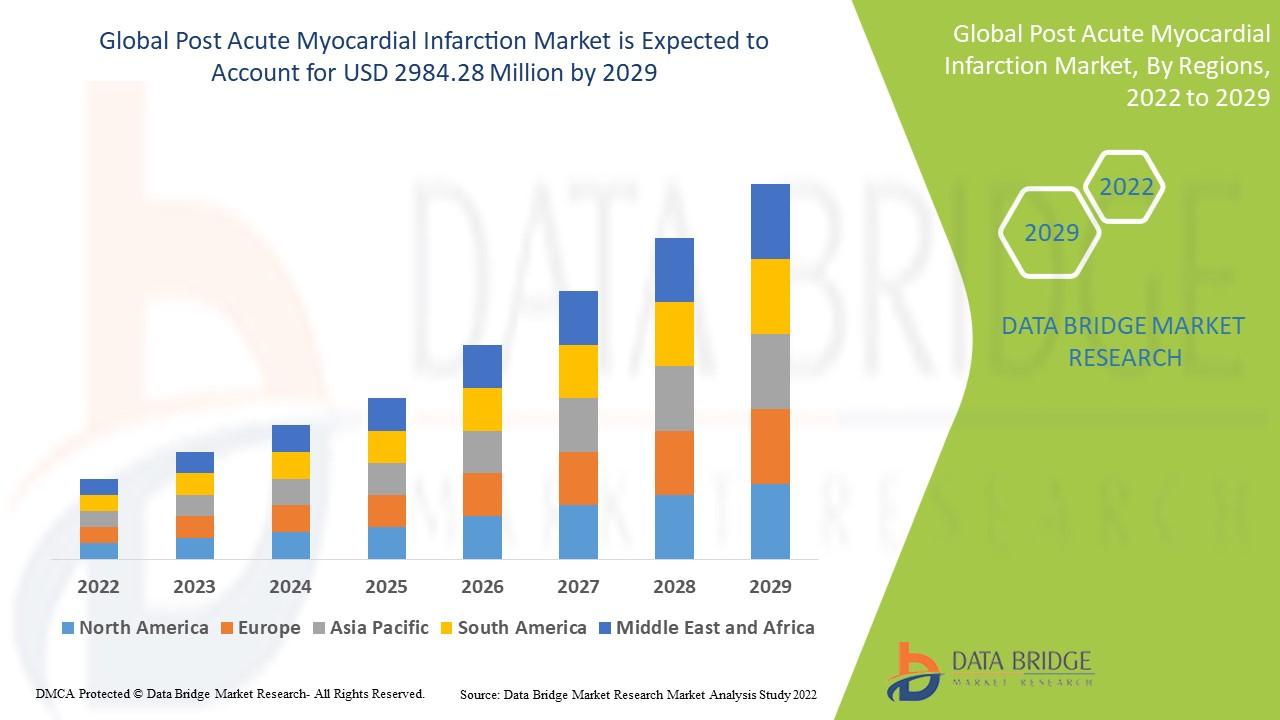

By Region

North America

Europe

Asia-Pacific (APAC)

Latin America

Middle East & Africa (MEA)

In many projections, Asia-Pacific is expected to exhibit the highest CAGR, followed by Latin America and the Middle East & Africa, driven by rising pet adoption rates, economic growth, and increasing awareness of pet health. Meanwhile, North America and Europe remain large, mature markets with significant per-pet spending and high ingredient standards.

6. Regional Analysis

North America

North America, led by the United States, already commands a strong share of the pet food ingredients market. High pet ownership rates, mature markets, advanced regulatory frameworks, and willingness to spend on premium pet nutrition underpin the region’s dominance. Ingredient suppliers here often lead in innovation, clean-label offerings, and regulatory compliance.

Europe

In Europe, strong regulatory oversight (e.g., EU regulations on feed additives, novel foods) and consumer demand for sustainable, organic, and clean-label pet products drive the region. Countries such as Germany, the UK, France, and the Netherlands are key hubs. European consumers exhibit a high level of awareness about ingredient sourcing, sustainability, and transparency.

Asia-Pacific

Asia-Pacific is emerging as the fastest-expanding region in the pet food ingredients market. Rising incomes, urbanization, growing middle class, and changing pet ownership trends in China, India, Japan, South Korea, and ASEAN nations fuel demand. Local ingredient production is gradually scaling up, while imports of specialized functional ingredients are also rising. Asia Pacific often shows double-digit percentage growth in ingredient demand.

Latin America

Latin America presents a growth frontier. Countries like Brazil, Mexico, Argentina, and Chile are seeing expanding pet ownership and rising pet food consumption. Ingredient supply chains are strengthening, though logistical and regulatory challenges remain. The tropical climate also influences ingredient selection and preservation needs.

Middle East & Africa

Though currently a smaller share, MEA is poised for upward movement. Increased disposable incomes, westernization of pet care culture in Gulf countries, and growing awareness present opportunities. However, regulatory fragmentation, logistical constraints, and lower baseline spending pose challenges. Within MEA, the Gulf Cooperation Council (GCC) nations often act as entry points for premium pet food and ingredient imports.

7. Competitive Landscape

The pet food ingredients market is concentrated, with several established global players and numerous niche specialists. Some of the major players (not exhaustive) include:

Cargill, Inc.

Archer Daniels Midland (ADM)

DuPont Nutrition & Biosciences / IFF

DSM (Royal DSM)

BASF SE

Lonza Group

Alltech, Inc.

Evonik Industries

Koninklijke DSM

Kerry Group

Comparative Strategies

Innovation & R&D leadership: Major firms invest heavily in internal R&D or acquisitions of biotech / startup ingredient firms to develop novel proteins, advanced functional additives, and processing technologies.

Strategic acquisitions & partnerships: Many ingredient companies acquire smaller niche firms or partner with pet food brands to secure co-development agreements. This enhances their portfolios and strengthens their go-to-market.

Sustainability and traceability focus: Leading players emphasize sustainable sourcing, carbon footprint reduction, zero-waste production, and blockchain-based traceability to appeal to conscious consumers and meet regulatory demands.

Cost-optimization & scale advantage: Large firms leverage economies of scale, integrated supply chains, and vertical integration (owning raw-material sourcing and processing) to remain cost-competitive, especially in mature categories.

Regional expansion & localization: Some players set up regional production or formulation labs to better serve local markets, reduce import costs, and meet regional regulatory requirements.

Value-added services & technical support: To distinguish themselves, many ingredient suppliers offer formulation assistance, customized blends, analytical services, and technical training for pet food customers.

Because the competitive dynamics combine scale, specialization, intellectual property, and regulatory expertise, entry into this space requires careful strategy.

8. Future Trends & Opportunities

Looking ahead over the next 5 to 10 years, several compelling trends and opportunities will shape the pet food ingredients market:

8.1 Rise of Precision & Personalized Nutrition

Advances in pet genomics, microbiome profiling, and digital health will enable tailored nutrition formulas for individual pets. Ingredient suppliers capable of offering modular, customizable inputs or modular premixes will be in demand.

8.2 Expansion of Alternative and Circular Proteins

Continued investment in insect proteins, algae, microbial fermentation, and cell-cultured proteins will yield scalable, cost-effective sources. Also, upcycled or valorized by-products (e.g., fish processing waste, brewer’s spent grain) will become more mainstream.

8.3 Clean-Label, Natural & Organic Ingredients

Consumer preference will continue to tilt toward recognizable, minimally processed ingredients with fewer synthetic additives. Ingredients labeled “non-GMO,” “organic,” “naturally derived,” or “plant-based” will carry premium value.

8.4 Smart & Functional Delivery Systems

Nanotechnology, microencapsulation, sustained-release formulations, and targeted delivery systems will become more common, improving ingredient stability, absorption, and efficacy in complex pet food formulations.

8.5 Digital Supply Chain & Blockchain Traceability

Blockchain, IoT sensors, and digital tracking will ensure transparency and traceability in ingredient sourcing, addressing concerns over adulteration, contamination, and authenticity.

8.6 Regional Ingredient Ecosystem Building

To reduce reliance on imports, emerging markets (especially in Asia-Pacific and Latin America) will see growth in local ingredient manufacturing capacity. Partnerships with agricultural sectors, biotech firms, and governments will accelerate this development.

8.7 Growth of Specialty & Niche Pet Nutrition Trends

Segments such as senior pet formulations, weight management, breed-specific diets, allergy and sensitivity diets, and cognitive-enhancement nutrition will require specialized ingredients and formulations, opening windows for niche ingredient suppliers.

8.8 ESG-Driven Formulas & Certifications

Environmental, Social, and Governance (ESG) concerns will push ingredient firms to adopt greener processes, ethical sourcing, fair-trade certification, and carbon-neutral goals. Those with credible ESG credentials will gain stakeholder and consumer trust.

8.9 Investment & M&A Activity

The coming period will likely see continued consolidation, strategic acquisitions, and venture capital funding into promising ingredient technologies. Investors will look for high-margin, defensible, technology-driven niche players.

For businesses, the opportunities lie in carving out niches—e.g. specialty functional additives, regional supply, or enabling technologies. For investors, backing innovation in alternative proteins, delivery systems, or traceability platforms could yield substantial returns. Policymakers can support the market by streamlining regulatory approval processes, incentivizing sustainable sourcing, and aligning safety guidelines across borders.

9. Conclusion

The Pet Food Ingredients Market stands at a compelling juncture, blending the foundations of traditional animal-nutrition with the innovation-driven demands of modern pet owners. From global scale to niche specializations, the market is poised for sustained growth (estimated CAGR of 6 %–8 %) driven by premiumization, novel proteins, functional ingredients, sustainability, and regulatory evolution.

Key takeaways:

The shift toward premium, natural, and functional pet nutrition is elevating ingredient complexity and value.

Regions like Asia-Pacific and Latin America are emerging as growth hotspots, while North America and Europe continue to lead in innovation and regulatory maturity.

Competitive advantage will favor ingredient suppliers with strong R&D, regulatory expertise, and sustainable practices.

Challenges around raw-material volatility, regulatory barriers, and technical formulation must be managed proactively.

Future trends in personalized nutrition, smart delivery, alternative proteins, and ESG alignment present high-opportunity paths for forward-looking players.

For businesses, the time is ripe to explore strategic innovation, partnerships, and regional expansion. For stakeholders and investors, niche ingredient technologies and platforms represent promising avenues of growth. For policy-makers, fostering harmonized regulation and sustainable practices will enable the sector to flourish responsibly.

In sum, the pet food ingredients industry offers a vibrant and evolving opportunity landscape—where those who blend scientific innovation with regulatory excellence and consumer insight can carve enduring success.

Frequently Asked Questions (FAQ)

Q1. What is the expected CAGR for the pet food ingredients market?

A1. The projected CAGR over the next five to ten years ranges between 6 % and 8 %, depending on region and segment dynamics.

Q2. Which ingredient types are growing the fastest?

A2. Functional additives (probiotics, enzymes, antioxidants) and novel proteins (insect, microbial, algae) are among the fastest-growing categories, propelled by premiumization and differentiation.

Q3. Which regional market offers the highest growth potential?

A3. Asia-Pacific is often forecasted to outpace others in percentage growth, supported by rising pet adoption, urbanization, and increased pet care spending.

Q4. What are major challenges ingredient suppliers face?

A4. Key challenges include regulatory approval complexity, raw-material volatility, margin pressure, technical compatibility in formulations, and heightened consumer safety expectations.

Q5. How can new firms enter this market successfully?

A5. New entrants should focus on niche or emerging segments, invest in R&D and regulatory expertise, leverage partnerships with pet food brands, and differentiate via sustainability or functional innovation.

Browse More Reports:

Global Dental CAM Milling Machine Market

Global Dental Cement Market

Global Dental Scaling Market

Global Dermatology Endoscopy Devices Market

Global Diaper Attachment Sensors Market

Global Digital Behavioural Health Services Market

Global Digital Diabetes Management Market

Global Digital e-Mail Marketing Automation Software Market

Global Digital Hearing Aids Market

Global Digital Out-of-Home Advertising Market

Global Digital Ovulation Test Kit Market

Global Dimethoxyethane Market

Global Disaster Recovery-as-a-Service Market

Global Distillers’ Grains Market

Global Diverticulitis Market

Global Electrochromic Glass and Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"