The Hydrogen Hegemony: Mapping Global Electrolyzers Market Share

As of February 2026, the international energy landscape has reached a definitive turning point, with the transition toward carbon-neutral fuels moving from localized pilot projects into a phase of massive industrial deployment. Central to this transformation is the Electrolyzers Market Share, which is currently being contested by legacy industrial giants and agile clean-tech innovators. This competitive arena is no longer just about technological superiority; it is a high-stakes race for manufacturing scale, supply chain security, and regional dominance. As the demand for green hydrogen surges—driven by the decarbonization mandates of the steel, ammonia, and heavy transport sectors—the distribution of market power is consolidating around those who can provide gigawatt-scale capacity. In 2026, the market is defined by a distinct "east-to-west" competition, where Chinese manufacturers leverage massive domestic volume to drive down costs, while European and North American firms focus on high-efficiency, premium technologies to maintain a strategic foothold in the global green economy.

The Rise of the Gigafactory Titans

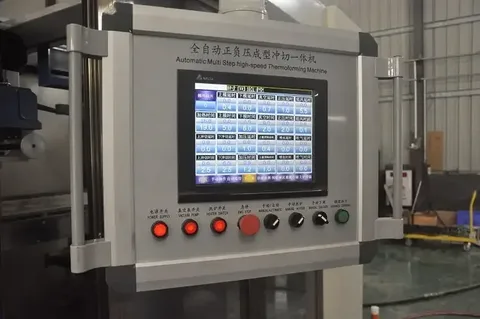

A primary driver of market share shifts in 2026 is the emergence of the "Electrolyzer Gigafactory." Major players like LONGi Hydrogen, Plug Power, and Thyssenkrupp Nucera have successfully transitioned from manual, project-based assembly to automated, high-volume production lines. LONGi Hydrogen, a subsidiary of the Chinese solar giant, has captured a significant portion of the global volume by applying the same economies of scale that revolutionized the photovoltaic industry. By offering large-scale alkaline systems at aggressive price points, they have become the preferred supplier for massive hydrogen hubs in Asia and the Middle East.

Conversely, Western firms like Plug Power and ITM Power have focused their share-grabbing strategies on the Proton Exchange Membrane (PEM) segment. These companies have established a dominant position in the North American and European markets by offering highly responsive, modular systems that are better suited for direct integration with variable wind and solar power. In 2026, the ability to offer "turnkey" solutions—where the electrolyzer, power electronics, and gas purification are sold as a single, integrated unit—has become the primary differentiator for capturing market share among industrial customers who prioritize rapid deployment over initial capital savings.

Regional Strongholds and the Policy Push

The geography of market share in 2026 is heavily influenced by national hydrogen strategies and regional subsidies. The Asia-Pacific region currently holds the largest share of global installed capacity, led by China's aggressive domestic rollout and India's "National Green Hydrogen Mission." These markets are characterized by a preference for alkaline technology, which accounts for nearly three-quarters of the regional volume due to its established reliability and lower upfront costs.

In contrast, Europe remains the intellectual and regulatory heart of the industry. European firms like Nel ASA and Siemens Energy hold a commanding share of the research-intensive segments, including high-temperature Solid Oxide Electrolyzer (SOEC) systems. The European Union’s carbon pricing mechanisms have created a "floor" for green hydrogen demand, ensuring that local manufacturers have a stable domestic market to test next-generation high-efficiency stacks. Meanwhile, in North America, the Inflation Reduction Act has catalyzed a massive shift in market share toward domestic manufacturers, as tax credits for clean hydrogen production make localized supply chains more economically attractive than imported hardware.

Technology Segments: The Battle for Efficiency

When analyzing the 2026 market share by technology, a clear specialization is emerging. Alkaline electrolyzers still command the majority of the market by volume, particularly in the chemicals and refining industries where a steady, predictable supply of hydrogen is required. These systems have benefited from decades of operational data, giving risk-averse industrial giants the confidence to invest in multi-megawatt installations.

However, the "growth share" is increasingly moving toward PEM and emerging AEM (Anion Exchange Membrane) technologies. PEM systems are winning the race in the mobility and grid-balancing sectors, where the ability to start and stop production instantly is crucial. In 2026, we are also seeing the first commercial inroads of AEM electrolyzers, which aim to combine the low cost of alkaline systems with the high performance of PEM. As these newer technologies move down the cost curve, they are beginning to nibble away at the traditional dominance of alkaline stacks, particularly in decentralized "on-site" hydrogen production for fueling stations and remote industrial sites.

Conclusion: A Consolidated Future for Clean Energy

As we look toward the 2030 horizon, the electrolyzers industry is entering a period of consolidation. The "wild west" era of dozens of small startups is giving way to an industry dominated by a handful of diversified energy companies and specialized manufacturing powerhouses. In 2026, market share is increasingly won through strategic partnerships—utilities partnering with manufacturers to build integrated energy storage, and steelmakers signing exclusive supply agreements to ensure they can meet their green steel targets. The winners in this decade are those who have successfully bridged the gap between engineering innovation and industrial-scale manufacturing. As the molecular backbone of the net-zero economy, the electrolyzer has finally taken its place as one of the most important industrial assets of the 21st century.

Frequently Asked Questions

Which technology currently holds the largest share of the electrolyzer market? In 2026, alkaline electrolyzers continue to hold the largest share of total installed capacity worldwide. This is primarily due to their long history of industrial use, lower capital costs, and the use of abundant materials like nickel. However, PEM (Proton Exchange Membrane) technology is the fastest-growing segment, particularly in markets where hydrogen production is directly linked to variable wind and solar energy.

Which region leads the world in electrolyzer manufacturing and deployment? The Asia-Pacific region, led by China, currently leads in both manufacturing volume and total installed capacity. China has leveraged its massive industrial base and solar supply chains to produce low-cost electrolyzers at a scale that other regions are still working to match. Europe follows closely as the leader in high-efficiency technology and regulatory frameworks, while North America is the fastest-growing market for high-capacity PEM installations.

Who are the major companies driving the market share in 2026? The market is dominated by a mix of established industrial giants and specialized hydrogen firms. Key players include LONGi Hydrogen, Plug Power, Nel ASA, Thyssenkrupp Nucera, Siemens Energy, and ITM Power. These companies are increasingly moving toward "Gigafactory" models of production to achieve the economies of scale necessary to dominate the global market.

More Trending Reports on Energy & Power by Market Research Future

South Korea Building Integrated Photovoltaics Market Share

APAC Busbar Systems Market Share

Canada Busbar Systems Market Share