Molecular Diagnostics Market Gains Momentum with Technological Innovations

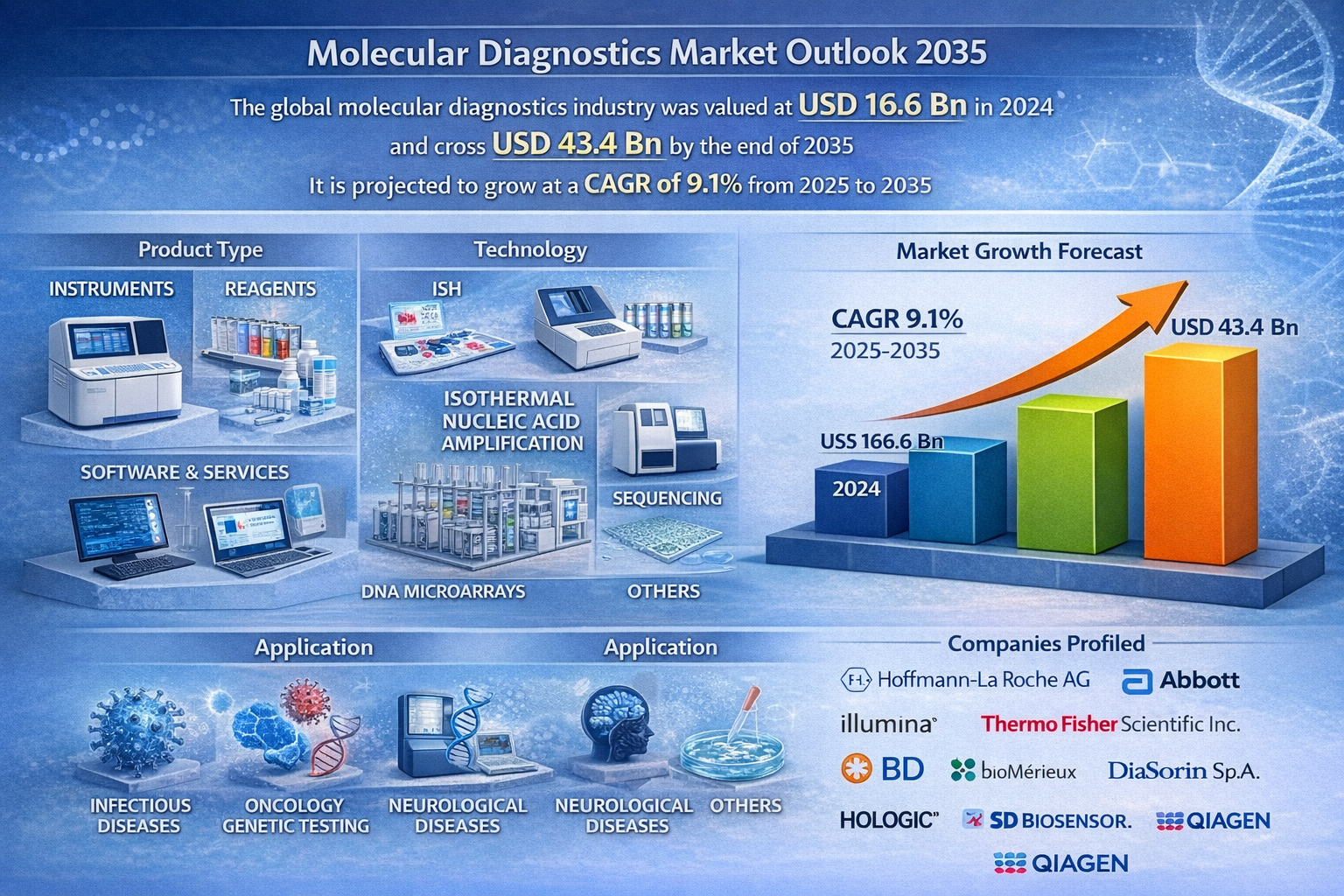

The global molecular diagnostics market was valued at USD 16.6 billion in 2024 and is projected to cross USD 43.4 billion by the end of 2035, reflecting strong and sustained growth. The market is expected to expand at a CAGR of 9.1% from 2025 to 2035, driven by rising prevalence of infectious and chronic diseases, increasing adoption of personalized medicine, technological advancements in PCR and sequencing, and growing demand for early and accurate disease detection.

The molecular diagnostics market is expanding at a rapid pace due to rise in incidence of infectious diseases and cancer along with increasing frequency of genetic disorders, thereby resulting in increased need for quick and precise diagnostics. Technological developments in PCR, liquid biopsy, next generation sequencing (NGS), and point-of-care diagnostics are enhancing diagnostics efficiency and application areas, including advances in personalized medicine to cater to the market.

Dive Deeper into Data: Get Your In-Depth Sample Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1783

The market for rapid diagnostics is projected to develop, including ascendance in certain segments like minimal residual disease (MRD) testing and companion diagnostics segments projected to realize the greatest growth revenue and consumption trends, and pharma companies pivoting diagnostics into point of need solutions.

Market Segmentation

By Service Type

- Assays & Kits (Consumables): The largest segment (~70% share). Recurring revenue from test kits remains the industry's "bread and butter."

- Instruments & Analyzers: High-capital equipment like PCR machines and NGS sequencers.

- Software & Services: The fastest-growing sub-segment, driven by the need for AI-based data interpretation and cloud-based genomic storage.

By Sourcing Type

- In-house Testing: Large hospitals and academic centers are increasingly bringing testing in-house to reduce turnaround times.

- Outsourced Services: Smaller clinics and pharmaceutical companies rely on specialized reference labs (e.g., Quest, Labcorp) and CDMOs for complex genomic analysis.

By Application

- Infectious Diseases: Still the volume leader (Flu, RSV, HPV, STI testing).

- Oncology: The highest value-driver, focused on early detection via liquid biopsy and companion diagnostics.

- Genetic Testing: Includes carrier screening, newborn screening, and ancestry.

- Pharmacogenomics: Tailoring drug prescriptions based on an individual’s genetic makeup.

By Industry Vertical

- Hospitals & Clinics: Primary end-users for rapid diagnostic needs.

- Diagnostic Laboratories: Centralized hubs for high-volume, complex testing.

- Academic & Research Institutes: Drivers of innovation and new biomarker discovery.

- Pharma & Biotech: Utilizing MDx for clinical trials and drug development.

By Region

- North America: The dominant market due to high healthcare spending and early adoption of precision medicine.

- Asia-Pacific: The fastest-growing region, fueled by infrastructure expansion in China, India, and South Korea.

Regional Analysis

- North America: Holds roughly 42% of the market share. The US market is characterized by a strong regulatory environment (FDA) and a rapid shift toward "LDT" (Laboratory Developed Test) oversight.

- Europe: Driven by stringent quality standards (IVDR) and high demand for prenatal and oncology screening.

- Asia-Pacific: Anticipated to see a CAGR of over 11% through 2035. Rising middle-class populations and government-led genomics initiatives (like "Genome India") are primary catalysts.

Market Drivers and Challenges

Drivers

- The Rise of Personalized Medicine: Shifting from treating symptoms to treating the patient’s specific genetic profile.

- Aging Population: Increased prevalence of age-related diseases like cancer and neurodegenerative disorders.

- Technological Convergence: The marriage of AI, microfluidics, and NGS has made testing faster and cheaper.

Challenges

- Regulatory Hurdles: New regulations (like the transition to IVDR in Europe) create high compliance costs for smaller players.

- Reimbursement Uncertainty: Convincing insurance providers to cover high-cost genomic tests remains a bottleneck in some regions.

- Skilled Labor Shortage: A global lack of trained bioinformaticians to interpret complex genetic data.

Market Trends

- Liquid Biopsy: Moving away from painful tissue biopsies to "blood-based" cancer monitoring.

- AI-Enhanced Diagnostics: AI is now used to spot patterns in genomic data that human pathologists might miss.

- Point-of-Care (POC) Multiplexing: Single-swab tests that can simultaneously check for 20+ respiratory pathogens.

- Decentralized Clinical Trials: Using molecular kits at home to monitor patients in pharmaceutical studies.

Future Outlook

The 2035 horizon looks "molecular-first." We expect to see Multi-Cancer Early Detection (MCED) tests become a standard part of annual physicals for adults over 50. Furthermore, the integration of CRISPR-based diagnostics will likely allow for real-time, ultra-sensitive pathogen detection in non-clinical settings, such as airports and schools.

Key Market Study Points

- NGS Dominance: Next-Generation Sequencing is expected to overtake PCR in total market value by 2032.

- Oncology Pivot: Oncology applications will likely represent 35% of all MDx revenue by 2035.

- Consumerization: Direct-to-consumer (DTC) health testing is evolving from "ancestry fun" to "clinically actionable" health reports.

Competitive Landscape

The market is a mix of "The Big Titans" and "The Disruptors":

- F. Hoffmann-La Roche: The global leader in integrated laboratory solutions.

- Abbott Laboratories: Dominates the POC and infectious disease space.

- Danaher (Cepheid): Known for the GeneXpert systems used globally.

- Thermo Fisher Scientific: A powerhouse in both research and clinical instruments.

- Illumina: The king of sequencing technology.

- QIAGEN: A leader in sample preparation and bioinformatics.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=1783<ype=S

Recent Developments

- In April 2025, Abbott announced the launch of its CE-marked HR HPV assay in Europe. The newly launched diagnostic assay includes self-collection of vaginal samples using the simpli-COLLECT HPV Collection Kit or the Evalyn Brush. The test is approved for use by healthcare providers either alone or in combination with a Pap test and helps HCPs to perform risk assessment by identifying HPV genotypes 16, 18, and 45 while reporting the concurrent detection of the other high-risk genotypes.

- In September 2024, QIAGEN launched the QIAcuityDx Digital PCR System, a digital PCR tool for clinical diagnostics. The instrument and accessories are FDA-exempt in the U.S. and IVDR-certified for Europe. It offers precise quantitation of target DNA and RNA, thereby making it ideal for monitoring cancer progression. QIAGEN is expanding its application menu and partnering with pharmaceutical companies for companion diagnostics.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com