Automotive Lightweight Materials Market Expands as Automakers Prioritize Weight Reduction and Efficiency

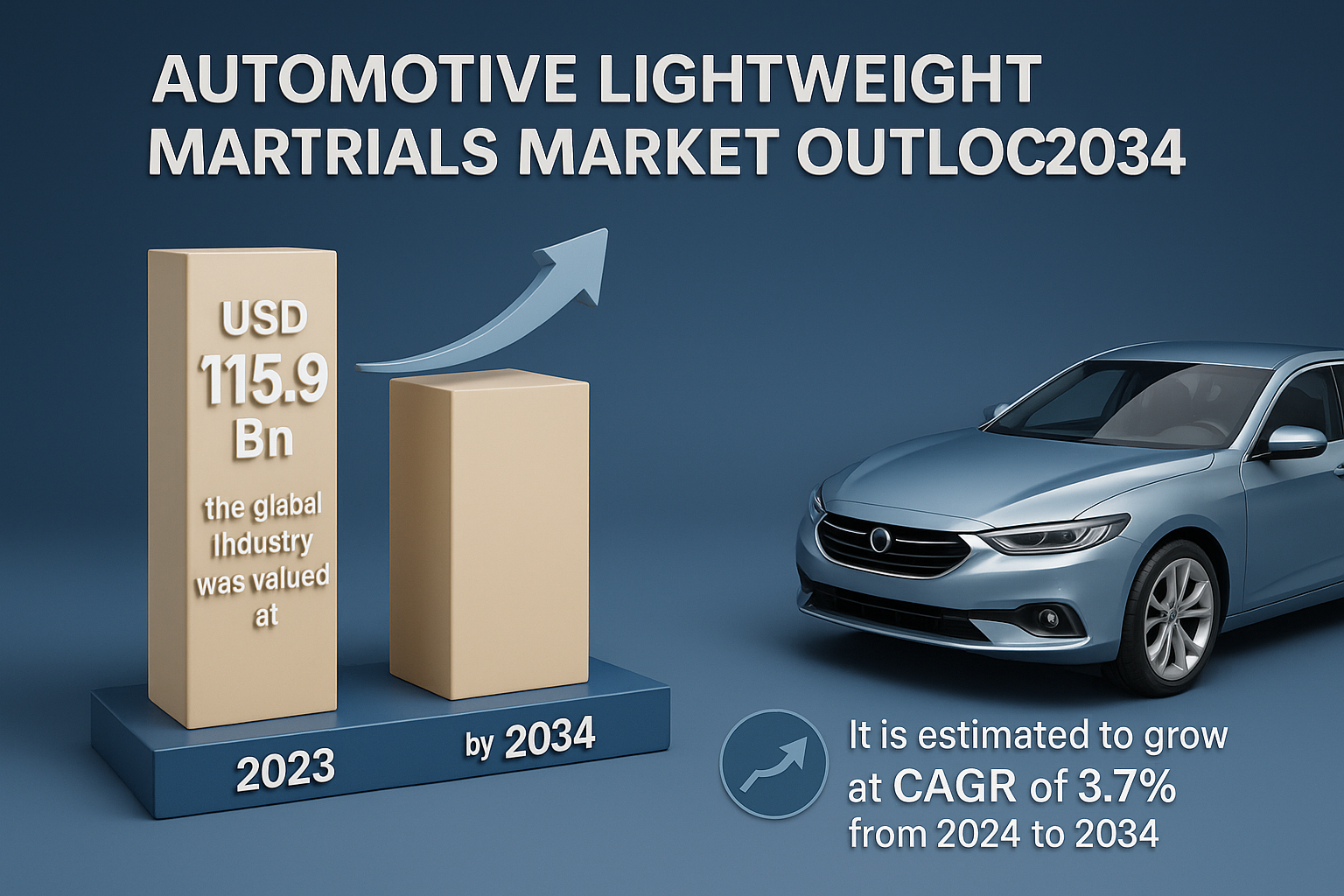

The Automotive Lightweight Materials Market is poised for steady expansion, with the global industry valued at USD 77.0 billion in 2023 and projected to reach USD 115.9 billion by 2034. This growth, advancing at a CAGR of 3.7% from 2024 to 2034, is driven by rising demand for fuel-efficient vehicles, stringent emission regulations, and the increasing adoption of electric vehicles, all of which push automakers toward advanced lightweight solutions such as high-strength steel, aluminum, magnesium, and composites.

Automotive lightweight materials help reduce weight and improve performance, fuel efficiency, and sustainability of vehicles. These vehicle weight reduction materials are largely used in the manufacture of EVs, as they provide a lightweight solution that helps maintain strength and integrity.

Dive Deeper into Data: Get Your In-Depth Sample Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=8509

Lightweight materials such as plastics, polymer composites, titanium, and steel are widely employed in the manufacture of automobiles, as they help enhance fuel efficiency and performance of vehicles.

OEMs are focusing on reducing the weight of various components such as powertrains, frames, and interior and exterior systems. Lightweight car materials are known to offer noticeable improvements over metals due to their stiffness and strength.

Market Segmentation

The market is segmented based on Material, Application, and Vehicle Type.

|

Segment |

Sub-Segment |

Key Insights (2024 Market Share/Trend) |

|

By Material Type |

Composites (Carbon Fiber, Glass Fiber), Metals (Aluminum, High-Strength Steel, Magnesium, Titanium), Plastics, Elastomers |

Composites hold a significant market share (approx. 66% in 2024), valued for their superior strength-to-weight ratio. The Metal segment (especially aluminum) is also a major contributor. |

|

By Application |

Body in White (BiW), Chassis and Suspension, Powertrain, Closures, Interiors, Others |

Body in White (BiW) is the leading application segment (approx. 25-26% share in 2024), as it forms the vehicle's structural frame and is critical for overall weight management. |

|

By Vehicle Type |

Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) |

Passenger Vehicles dominate the market (approx. 83% share in 2024), driven by high production volumes and consumer demand for fuel-efficient and electric models. LCVs are expected to show a notable growth rate. |

Segmentation by Industry Vertical and Sourcing Type are usually subsumed under Application/Material Type and Production Method in automotive market reports, focusing on the material's origin and final use.

Regional Analysis

The adoption rates and market dominance vary significantly across regions, influenced by regulatory landscapes and automotive production hubs.

- Europe: Largest Market Share (approx. 35-36% in 2024). This dominance is attributed to the EU's stringent CO2 emission reduction targets, compelling European OEMs to be early adopters of light weighting technologies, particularly in the premium and EV segments.

- Asia-Pacific (APAC): Fastest Growth Rate is anticipated. This is driven by the rapid expansion of the automotive industry, significant EV adoption (especially in China), and increasing regulatory pressure for fuel efficiency. China and India are key growth markets.

- North America: Expected to witness substantial growth, supported by the rising demand for SUVs and pickups utilizing aluminum-intensive designs, and government efforts to encourage EV production and meet fuel economy standards.

Market Drivers and Challenges

Market Drivers

- Stringent Emission and Fuel Efficiency Regulations: Global mandates (like EU CO2 targets and US CAFE standards) compel manufacturers to reduce vehicle weight to improve fuel economy and reduce carbon footprints.

- Rising Demand for Electric Vehicles (EVs): Lightweight materials are critical for offsetting the heavy weight of battery packs, thereby extending the driving range and enhancing energy efficiency of EVs.

- Advancements in Material Science: Ongoing innovations in composites, advanced high-strength steels (AHSS), and new alloys provide materials with superior strength-to-weight ratios, making them viable replacements for traditional steel.

Market Challenges

- High Cost and Manufacturing Complexity: Advanced materials, especially carbon fiber and specialty alloys, are expensive and require specialized joining and manufacturing processes, which can increase overall vehicle production costs.

- Recycling Infrastructure Gaps: Recycling complex multi-material structures and certain composites remains a technological and logistical challenge, hindering full circularity.

Market Trends

- Multi-Material Architectures: The industry is increasingly adopting hybrid designs that strategically combine different lightweight materials (e.g., aluminum, steel, and composites) in a single vehicle structure to optimize cost, weight, and performance.

- Focus on Sustainable Materials: Growing environmental consciousness is driving R&D toward sustainable and recyclable lightweight solutions, including recycled aluminum, bio-based polymers, and closed-loop systems for composite materials.

- Role of AI and Additive Manufacturing: Artificial Intelligence (AI) is being used for predictive modeling and design optimization of new materials, while Additive Manufacturing (3D printing) is helping to create complex, lightweight components with minimal material waste.

Future Outlook and Key Market Study Points

The market is set for continuous innovation, with the imperative of electrification defining the future trajectory.

- Future Outlook: The market is expected to thrive as EV production scales up globally. The focus will shift towards cost-effective, high-volume production of lightweight battery enclosures and structural components.

- Key Market Study Points:

- The total material substitution potential in EVs.

- The cost-reduction pathways for high-performance composites.

- The impact of new joining technologies (e.g., adhesive bonding, laser welding) on multi-material assembly.24

- The demand dynamics for aluminum in large vehicle segments (pickups/SUVs).

Competitive Landscape

The Automotive Lightweight Materials market is highly competitive, featuring both large global material suppliers and specialized component manufacturers. Key industry participants are engaged in continuous R&D and strategic collaborations with OEMs to secure long-term supply agreements.

Leading Companies Mentioned in the Industry:

- BASF SE

- ArcelorMittal SA

- Novelis Inc.

- Toray Industries, Inc.

- LyondellBasell Industries Holdings B.V.

- 3M Company

- Tata Steel Company

- ThyssenKrupp AG

Recent Developments

- Material Innovation for EVs: Companies are increasingly launching new material formulations, such as thicker, specialized film for windows (e.g., Toray Industries' PICASUS IR film) and novel thermoplastic elastomers (e.g., Si-TPV) that offer both lightness and specific performance enhancements (thermal management, corrosion resistance) critical for EV battery systems.

- Strategic Collaborations: OEMs are deepening partnerships with material specialists, such as the collaboration between Hyundai-Kia and BASF on concept cars, to integrate sustainable and advanced materials (plastics, textiles, and steel) early in the design phase.

- Expansion of Additive Manufacturing: The commercialization of new feedstock materials (e.g., Stratasys' SAF Polypropylene) and technologies for 3D printing is expanding its application in producing lighter, customized automotive parts.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=8509<ype=S

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com