Energy Engineering Service Outsourcing Market: Paving the Way for Efficient Energy Management

As per Market Research Future, the Energy Engineering Service Outsourcing Market is witnessing a robust upsurge as industries and energy companies worldwide increasingly look to external experts for managing complex engineering needs. With growing demand for optimized energy usage, cost reduction, and regulatory compliance, outsourcing energy engineering tasks has emerged as a strategic choice. This trend is being driven by a combination of technological advancements, tightening environmental regulations, and the pressing need for companies to focus on their core competencies while leveraging specialized third-party expertise.

The outsourcing of energy engineering services typically covers a wide range of functions — from design and planning of energy systems, energy audits, performance monitoring, to maintenance and retrofitting of existing infrastructure. As energy-intensive sectors such as manufacturing, utilities, oil & gas, and construction confront rising energy costs and regulatory pressures, many are opting to contract external firms that possess both the technical know-how and capacity to deliver optimized solutions. For clients, this translates to reduced capital expenditure, improved energy efficiency, and better compliance with evolving environmental and safety standards.

One of the key forces propelling this market is the global push toward sustainability and carbon emission reduction. With governments implementing stricter energy efficiency norms and carbon taxes, companies are compelled to reevaluate their energy utilization strategies. Outsourcing players with expertise in renewable integration, smart metering, and energy-efficient retrofits play a vital role in enabling firms to adhere to environmental standards while ensuring operational efficiency. This is especially relevant in regions undergoing industrial modernization, where legacy systems are being overhauled in favor of more sustainable, high-performance energy infrastructures.

Another major driver is the accelerating pace of technological innovation. Modern energy engineering outsourcing firms harness advanced tools such as energy management software, predictive maintenance using IoT sensors, and data-driven analytics. These tools enable real-time monitoring, early detection of inefficiencies, and suggest corrective measures — significantly cutting downtime and energy waste. Additionally, many outsourcing providers are expanding their services to offer consultancy, compliance audits, and sustainability reporting services, making them one-stop partners for organizations aiming to meet both operational and environmental goals.

However, this burgeoning market is not without challenges. One significant obstacle is the initial hesitation of companies to relinquish control over critical energy infrastructure. Concerns around confidentiality, long-term dependence, and the perceived risk associated with outsourcing core engineering functions can deter firms from transitioning. Further, the cost-benefit equation for outsourcing varies greatly with the scale of operations — smaller operations may not see sufficient returns on outsourcing compared to larger, energy-intensive enterprises.

Moreover, there is a shortage of skilled outsourcing providers in regions where demand is growing fast. Expertise in advanced energy systems, regulatory compliance, and data analytics is in limited supply, which sometimes leads to quality gaps or delayed project execution. To overcome this, many outsourcing firms are investing in building specialized teams, training, and leveraging partnerships to meet rising demand.

Looking ahead, the Energy Engineering Service Outsourcing Market is poised for substantial growth. As industries across emerging and developed economies embark on modernization, digitalization, and greening of their energy infrastructure, outsourcing is likely to become a standard operational strategy. The integration of renewable energy sources, energy storage systems, and smart grid technology will further push the demand for skilled external engineers. Additionally, as global environmental policies become more stringent and corporate sustainability commitments intensify, companies will increasingly rely on outsourced expertise for compliance, energy audits, and efficiency upgrades. This transition could reshape how organizations manage energy — moving from in-house maintenance to a model where specialized service providers handle a major chunk of engineering responsibilities. In this scenario, outsourcing becomes not just a cost-saving measure, but a strategic enabler of sustainable growth.

FAQs

1. What kinds of services are typically outsourced under energy engineering service outsourcing?

Outsourced services can include energy system design and planning, energy audits, performance monitoring, equipment maintenance and retrofitting, integration of renewable energy systems, and compliance audits related to energy and environmental regulations.

2. Which industries benefit most from outsourcing energy engineering services?

Energy-intensive sectors such as manufacturing, utilities, oil & gas, construction, and large commercial enterprises benefit greatly. These industries often operate complex energy systems and face high energy costs, making outsourcing a practical way to improve efficiency and reduce overheads.

3. What are the main challenges companies face when outsourcing energy engineering services?

Major challenges include reluctance to cede control over critical infrastructure, concerns about long-term dependence on external providers, potential quality or expertise shortages among service vendors, and uncertainty over whether outsourcing offers tangible cost savings, especially for smaller operations with modest energy needs.

Categorii

Citeste mai mult

In-Depth Study on Executive Summary Point of Sale (POS) Payment Technologies Market Size and Share Point of sale (POS) payment technologies market size is valued at USD 35,691.58 million by 2028 is expected to grow at a compound annual growth rate of 16.90% in the forecast period of 2021 to 2028. As the high quality Point of Sale (POS) Payment Technologies Market survey report...

Data Bridge Market Research analyses that the aluminium solenoid valves market was valued at USD 542.3 million in 2021 and is expected to reach the value of USD 736.49 million by 2029, at a CAGR of 3.90% during the forecast period. The global business landscape is undergoing a transformation, with industries increasingly leaning on deep research and actionable insights to make strategic...

The Armoured Civilian Vehicles Market is experiencing steady growth as personal security becomes a top priority for individuals in high-risk regions, corporate executives, celebrities, and government officials. Armoured civilian vehicles, designed to provide protection against bullets, explosives, and other threats, combine luxury, performance, and advanced security features....

The winter and all-season tires market is experiencing robust growth as vehicle owners increasingly prioritize safety, performance, and adaptability in diverse driving conditions. These tires are essential for providing optimal traction, handling, and durability across varying climates. The rising demand for passenger cars, SUVs, and light commercial vehicles has accelerated the...

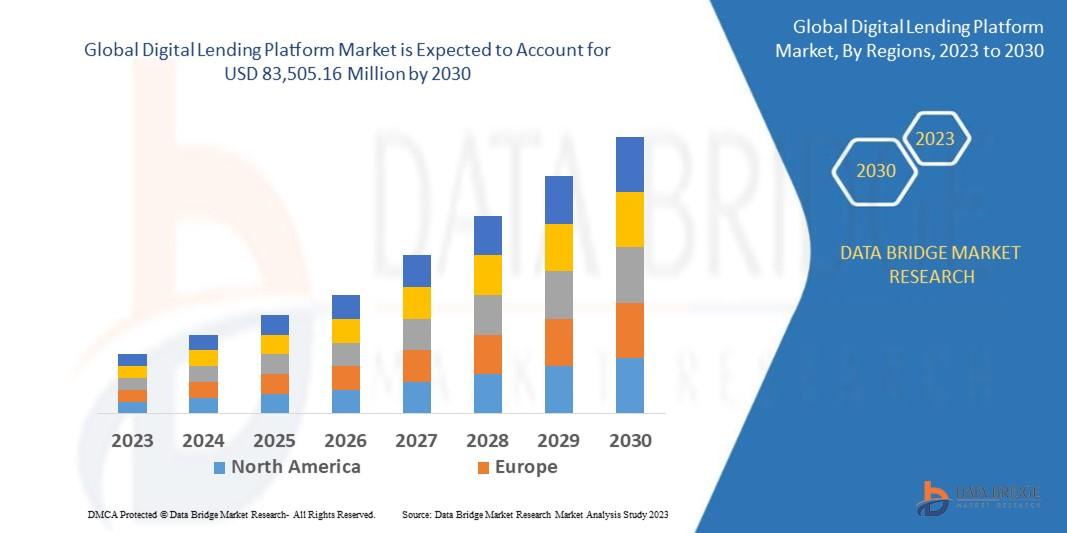

"Regional Overview of Executive Summary Digital Lending Platform Market by Size and Share CAGR Value Data Bridge Market Research analyses that the global digital lending platform market which was USD 20,215.23 million in 2022, is expected to reach USD 83,505.16 million by 2030, and is expected to undergo a CAGR of 19.4% during the forecast period of 2023 to 2030. A study...