Energy Engineering Service Outsourcing Market: Paving the Way for Efficient Energy Management

As per Market Research Future, the Energy Engineering Service Outsourcing Market is witnessing a robust upsurge as industries and energy companies worldwide increasingly look to external experts for managing complex engineering needs. With growing demand for optimized energy usage, cost reduction, and regulatory compliance, outsourcing energy engineering tasks has emerged as a strategic choice. This trend is being driven by a combination of technological advancements, tightening environmental regulations, and the pressing need for companies to focus on their core competencies while leveraging specialized third-party expertise.

The outsourcing of energy engineering services typically covers a wide range of functions — from design and planning of energy systems, energy audits, performance monitoring, to maintenance and retrofitting of existing infrastructure. As energy-intensive sectors such as manufacturing, utilities, oil & gas, and construction confront rising energy costs and regulatory pressures, many are opting to contract external firms that possess both the technical know-how and capacity to deliver optimized solutions. For clients, this translates to reduced capital expenditure, improved energy efficiency, and better compliance with evolving environmental and safety standards.

One of the key forces propelling this market is the global push toward sustainability and carbon emission reduction. With governments implementing stricter energy efficiency norms and carbon taxes, companies are compelled to reevaluate their energy utilization strategies. Outsourcing players with expertise in renewable integration, smart metering, and energy-efficient retrofits play a vital role in enabling firms to adhere to environmental standards while ensuring operational efficiency. This is especially relevant in regions undergoing industrial modernization, where legacy systems are being overhauled in favor of more sustainable, high-performance energy infrastructures.

Another major driver is the accelerating pace of technological innovation. Modern energy engineering outsourcing firms harness advanced tools such as energy management software, predictive maintenance using IoT sensors, and data-driven analytics. These tools enable real-time monitoring, early detection of inefficiencies, and suggest corrective measures — significantly cutting downtime and energy waste. Additionally, many outsourcing providers are expanding their services to offer consultancy, compliance audits, and sustainability reporting services, making them one-stop partners for organizations aiming to meet both operational and environmental goals.

However, this burgeoning market is not without challenges. One significant obstacle is the initial hesitation of companies to relinquish control over critical energy infrastructure. Concerns around confidentiality, long-term dependence, and the perceived risk associated with outsourcing core engineering functions can deter firms from transitioning. Further, the cost-benefit equation for outsourcing varies greatly with the scale of operations — smaller operations may not see sufficient returns on outsourcing compared to larger, energy-intensive enterprises.

Moreover, there is a shortage of skilled outsourcing providers in regions where demand is growing fast. Expertise in advanced energy systems, regulatory compliance, and data analytics is in limited supply, which sometimes leads to quality gaps or delayed project execution. To overcome this, many outsourcing firms are investing in building specialized teams, training, and leveraging partnerships to meet rising demand.

Looking ahead, the Energy Engineering Service Outsourcing Market is poised for substantial growth. As industries across emerging and developed economies embark on modernization, digitalization, and greening of their energy infrastructure, outsourcing is likely to become a standard operational strategy. The integration of renewable energy sources, energy storage systems, and smart grid technology will further push the demand for skilled external engineers. Additionally, as global environmental policies become more stringent and corporate sustainability commitments intensify, companies will increasingly rely on outsourced expertise for compliance, energy audits, and efficiency upgrades. This transition could reshape how organizations manage energy — moving from in-house maintenance to a model where specialized service providers handle a major chunk of engineering responsibilities. In this scenario, outsourcing becomes not just a cost-saving measure, but a strategic enabler of sustainable growth.

FAQs

1. What kinds of services are typically outsourced under energy engineering service outsourcing?

Outsourced services can include energy system design and planning, energy audits, performance monitoring, equipment maintenance and retrofitting, integration of renewable energy systems, and compliance audits related to energy and environmental regulations.

2. Which industries benefit most from outsourcing energy engineering services?

Energy-intensive sectors such as manufacturing, utilities, oil & gas, construction, and large commercial enterprises benefit greatly. These industries often operate complex energy systems and face high energy costs, making outsourcing a practical way to improve efficiency and reduce overheads.

3. What are the main challenges companies face when outsourcing energy engineering services?

Major challenges include reluctance to cede control over critical infrastructure, concerns about long-term dependence on external providers, potential quality or expertise shortages among service vendors, and uncertainty over whether outsourcing offers tangible cost savings, especially for smaller operations with modest energy needs.

Categorieën

Read More

The global folliculitis market size was valued at USD 1.98 billion in 2024 and is expected to reach USD 3.12 billion by 2028, growing at a CAGR of 5.81% during the forecast period. The global business landscape is undergoing a transformation, with industries increasingly leaning on deep research and actionable insights to make strategic decisions. One segment seeing...

Introduction The colorants market includes a diverse range of dyes, pigments, and specialty additives used to impart color to products. These materials are essential across industries such as textiles, plastics, paints, coatings, food and beverages, cosmetics, and construction. The market plays a major role in enhancing product aesthetics, improving brand identity, and increasing...

The Smart Polymers Market has expanded significantly, reflecting a growing smart polymers market size driven by applications in healthcare, packaging, and industrial sectors. The smart polymers market size is influenced by the rising adoption of stimuli-responsive materials for drug delivery, tissue engineering, and adaptive packaging solutions. Technological...

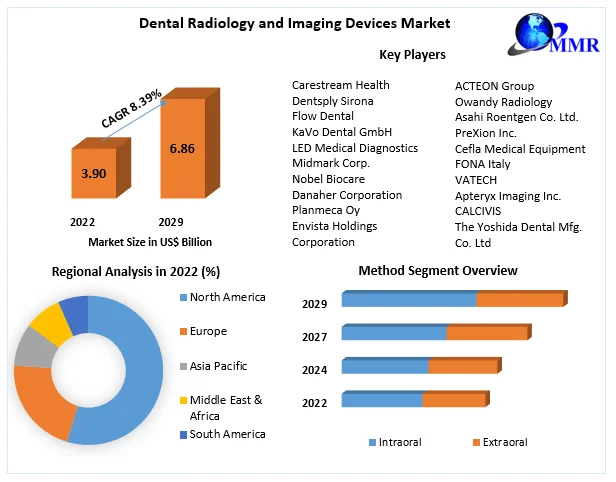

Dental radiology and Imaging Devices Market size was valued at US$ 3.90 Bn in 2022 and the total revenue is expected to grow at 8.39% through 2023 to 2029, reaching nearly US$ 6.86 Bn. Dental Radiology and Imaging Devices Market Report Overview: The report comprehensively encompasses the analysis of insights concerning the Dental Radiology and Imaging Devices...

Introduction The Automotive Component Two Wheeler Upside Down Forks Market is growing rapidly as motorcycle manufacturers and consumers increasingly prefer high-performance suspension systems that deliver superior stability, improved handling, and enhanced riding comfort. Upside-down (USD) forks, also known as inverted forks, are widely used in sport bikes, premium commuters, adventure...