Vehicle Loan & Leasing Solutions: Accelerating Access to Affordable Mobility Options

Vehicle loan and leasing solutions have become essential tools for both individuals and businesses looking to access modern vehicles without large upfront costs. As per MRFR analysis, the growing demand for flexible financing options and the increasing need for personal and commercial mobility are driving significant growth in vehicle loan & leasing solutions worldwide. These solutions enable consumers and organizations to acquire vehicles while managing financial risk, optimizing cash flow, and benefiting from the latest automotive technologies.

Rising Demand for Vehicle Loans

One of the primary factors driving growth in vehicle loan solutions is the increasing affordability of vehicles through structured financing. Consumers no longer need to pay the full price upfront, as loans allow them to spread payments over time with manageable interest rates. This accessibility is particularly appealing in emerging markets, where vehicle ownership is rising alongside disposable income. Moreover, the availability of online loan processing and simplified documentation has accelerated adoption, making it easier for buyers to access funds quickly and efficiently.

Growth of Leasing Solutions

Leasing solutions are gaining popularity due to the flexibility they offer. Unlike loans, leases allow customers to use vehicles for a fixed term and return them at the end of the contract, avoiding depreciation concerns. For businesses, leasing provides an opportunity to maintain modern fleets without significant capital investment. Leasing packages often include maintenance, insurance, and roadside assistance, reducing operational burdens. Companies benefit from predictable monthly expenses, easy fleet upgrades, and the ability to scale their vehicle requirements according to operational needs.

Technological Advancements Driving Market Trends

Technological innovation is a key trend shaping vehicle loan and leasing solutions. Financial technology platforms now offer seamless online applications, instant credit approvals, and AI-driven risk assessments. Additionally, connected vehicle technologies integrated into leased fleets provide real-time tracking, predictive maintenance, and enhanced operational efficiency. For lenders, data analytics allows better risk management and tailored financing solutions, while consumers benefit from personalized offers based on usage and driving patterns.

Sustainability and Green Financing

With the global shift toward eco-friendly transportation, vehicle loans and leasing solutions are increasingly supporting electric and hybrid vehicles. Green financing options, lower interest rates for EVs, and government incentives are encouraging adoption. Leasing in particular allows users to upgrade to newer, cleaner models periodically, aligning with sustainability goals while minimizing financial risk. This trend is expected to play a major role in shaping future market growth as regulatory support for environmentally responsible transportation intensifies.

Market Drivers

Several key factors are propelling the growth of vehicle loan and leasing solutions:

-

Rising vehicle demand in both personal and commercial segments.

-

Financial accessibility, allowing individuals and businesses to manage costs effectively.

-

Technological integration, offering streamlined digital platforms and connected vehicle solutions.

-

Increasing awareness of sustainable mobility, driving EV adoption through loans and leases.

-

Regulatory support and incentives, promoting financing solutions for new vehicle acquisition.

Conclusion

Vehicle loan and leasing solutions are becoming integral to modern mobility, offering financial flexibility, operational efficiency, and access to the latest automotive technologies. By enabling easier vehicle acquisition and supporting sustainable transportation, these solutions cater to both individual buyers and corporate fleets. As technology advances and environmental concerns grow, the vehicle financing market is poised for continued expansion, providing innovative solutions to meet evolving consumer and business needs.

FAQs

1. What is the difference between a vehicle loan and a vehicle lease?

A loan involves borrowing funds to purchase a vehicle and owning it, while a lease allows you to use the vehicle for a fixed term without ownership, with the option to return or buy it later.

2. Are electric vehicles available under financing and leasing programs?

Yes, both loans and leases often include electric and hybrid vehicles, with incentives, lower rates, and maintenance support for sustainable mobility.

3. How do vehicle financing solutions benefit businesses?

Leasing and loans help businesses maintain modern fleets, reduce upfront costs, manage expenses predictably, and integrate connected technologies for operational efficiency.

More Related Reports:

Kategoriler

Read More

Digital transformation continues to reshape global business operations, and mobility remains a key enabler of productivity, collaboration, and organizational efficiency. As enterprises deploy growing numbers of mobile devices and apps, the need for structured mobility oversight has become critical. These evolving requirements strengthen the relevance of the Managed Mobility Services Market...

Executive Summary: Autologous Fat Grafting Market Size and Share by Application & Industry The global Autologous Fat Grafting market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.99 billion by 2032, at a CAGR of 9.80% during the forecast period. For the growth of business, Autologous Fat Grafting Market analysis report...

Introduction The Data Center Construction Market refers to the planning, designing, and building of physical infrastructures that store, process, and distribute large volumes of digital data. These facilities consist of critical systems such as power distribution units, cooling equipment, security frameworks, networking hardware, and structural frameworks that support data-intensive...

The latest business intelligence report released by Polaris Market Research on Ginseng Extracts Market Share, Size, Trends, Industry Analysis Report, By Form (Powder, Liquid); By Application; By Region; Segment Forecast, 2021 - 2028. It covers the in-depth knowledge of the Ginseng Extracts Market Share that includes opportunities, growth factors, and challenges. The research...

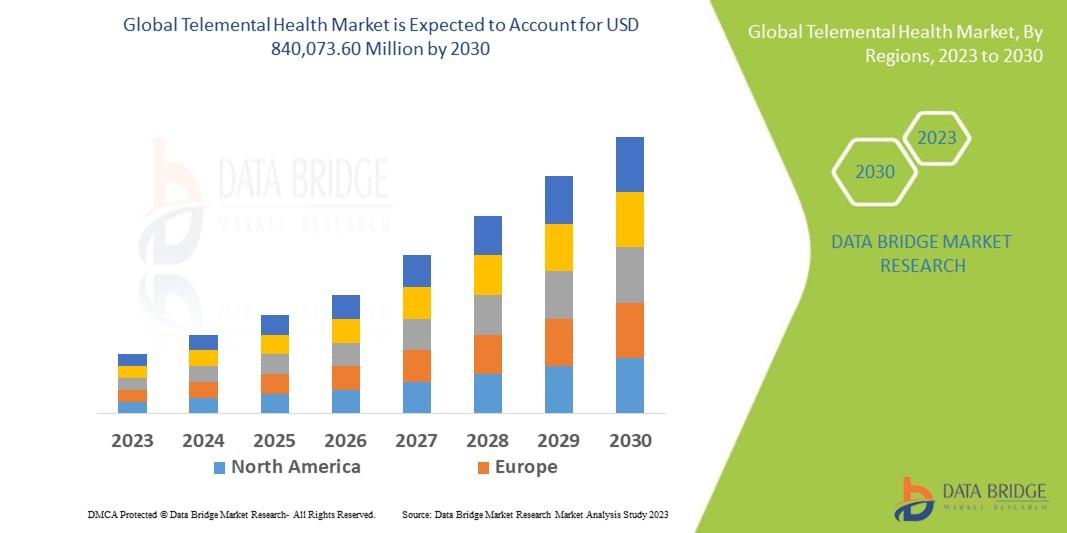

"Executive Summary Telemental Health Market Trends: Share, Size, and Future Forecast CAGR Value Data Bridge Market Research analyses that the global telemental health market which was USD 129,744.97 million in 2022, is expected to reach USD 840,073.60 million by 2030, and is expected to undergo a CAGR of 26.3% during the forecast period 2023-2030. By working with a number of...