Exploring the US Asset Performance Management Revenue Generation Models

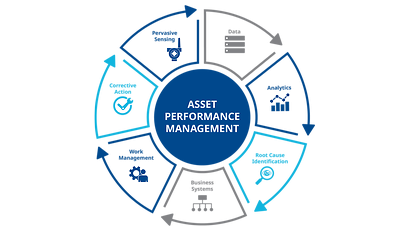

The primary sources of US Asset Performance Management revenue are diversifying as the market matures, moving away from traditional models towards more flexible and value-oriented approaches. Historically, the dominant model was perpetual software licensing, where customers would pay a large, one-time fee upfront for the right to use the software, followed by smaller, recurring annual fees for maintenance and support. While this model still exists, particularly for on-premise deployments in industries with strict data sovereignty or security requirements, it is rapidly being overshadowed. The shift towards cloud computing has paved the way for the Software-as-a-Service (SaaS) model, which is becoming the new standard. Under this subscription-based model, customers pay a recurring fee (monthly or annually), which lowers the initial barrier to entry and transforms a large capital expenditure (CapEx) into a more predictable operational expenditure (OpEx).

The SaaS model has fundamentally reshaped revenue streams and customer relationships in the APM market. For vendors, it provides a more predictable and stable recurring revenue stream, which is highly valued by investors. It also allows for continuous innovation, with updates and new features being rolled out to all customers seamlessly via the cloud. For customers, the SaaS model offers greater flexibility and scalability; they can scale their usage up or down based on their needs and often pay based on metrics such as the number of assets being monitored, the volume of data processed, or the number of users. This pay-as-you-go approach makes advanced APM capabilities accessible to a wider range of businesses, including small and medium-sized enterprises, thereby expanding the total addressable market and creating new revenue opportunities for vendors across different segments.

Beyond software subscriptions, professional services represent another significant and growing revenue stream for APM providers. Implementing an APM solution is not just a technology installation; it is a complex change management process that often requires a significant transformation of business processes and workflows. To ensure success, many vendors offer a suite of professional services, including initial consultation and strategy development, system integration with existing IT/OT infrastructure, data migration, and employee training. These services are crucial for helping customers achieve a tangible return on their investment and are a high-margin source of revenue. Furthermore, many providers offer ongoing premium support and dedicated reliability consulting services, where their experts work alongside the customer's team to analyze data, fine-tune analytical models, and drive continuous improvement, creating a long-term, value-added partnership.

Looking forward, new and innovative revenue models are emerging that tie a vendor's compensation directly to the value they create for the customer. These outcome-based or performance-based contracts are gaining traction, particularly in large-scale deployments. For example, an APM provider's revenue might be linked to specific key performance indicators (KPIs), such as a percentage of the reduction in unplanned downtime, a share of the maintenance cost savings achieved, or an increase in Overall Equipment Effectiveness (OEE). While more complex to structure, these models perfectly align the interests of the vendor and the customer, as the provider only succeeds when the customer achieves their desired business outcomes. This value-centric approach represents the future of revenue generation in the APM market, shifting the conversation from selling software features to delivering guaranteed performance improvements.

The US Asset Performance Management market is set for impressive growth, with projections showing its value rising from $1.2 billion in 2024 to $2.5 billion by 2035. This upward trajectory, defined by a 6.90% compound annual growth rate, is a direct result of the increasing industry-wide demand for strategies that drive peak asset efficiency.

Explore Our Latest Trending Reports: