Automotive LiDAR Sensors Market Analysis: Insights, Growth Drivers & Regional Trends

The global Automotive LiDAR Sensors Market is positioned at a pivotal juncture as the mobility landscape shifts towards advanced driver-assistance systems (ADAS), semi-autonomous and autonomous vehicles. LiDAR technology provides high-resolution three-dimensional mapping and object detection, making it a critical enabler for vehicle safety, perception and automation.

Market growth is being driven by several compelling factors. Firstly, safety regulations across many regions are becoming increasingly stringent, mandating features such as pedestrian detection, automatic emergency braking and lane-keeping assist—all of which benefit from LiDAR’s accuracy. As vehicles become more connected and autonomous the sensor suite required becomes more sophisticated and LiDAR adoption follows accordingly. Secondly, the integration of ADAS and autonomous applications in passenger, commercial and off-road segments is increasing, which fuels demand for robust LiDAR sensors. Automakers and suppliers view LiDAR as key to achieving higher levels of autonomy and differentiating in terms of safety capability. Thirdly, technological innovation is improving the affordability and scalability of LiDAR sensors, paving the way for wider deployment beyond premium vehicles. As costs fall and performance improves, usage moves down-market and into more vehicle segments. Lastly, macro trends such as electrification, shared mobility, and smart infrastructure are encouraging investment in sensor-rich vehicles and fleets, further creating demand for LiDAR-enabled systems.

Technological advancement is reshaping how LiDAR sensors are designed, manufactured and integrated within automotive architectures. One major trend is the development of solid-state LiDAR systems, which eliminate moving parts and thereby enhance reliability, reduce cost and improve packaging in vehicles. In parallel long-range LiDAR solutions are being refined to detect objects at greater distances, which is essential for high-speed driving and autonomous highway operation. Additionally the integration of LiDAR with other sensor modalities such as radar, cameras and ultrasonic systems through sensor-fusion algorithms enhances perception accuracy and robustness in complex environments. Innovations in miniaturisation, power efficiency, higher resolution imaging, and on-board processing also enable LiDAR sensors to be embedded within vehicle design more seamlessly. With increasing use of software-defined vehicle architectures and over-the-air update capabilities the LiDAR hardware must interface effectively with vehicle software ecosystems and advanced driver-aid systems. Furthermore as autonomous applications scale there is rising emphasis on mass-manufacturability, cost reduction and supply-chain localisation to ensure LiDAR becomes a standard feature rather than a luxury option.

Regional insights reveal distinct dynamics across geographies. In North America the LiDAR market is well advanced, supported by an ecosystem of tech companies, strong autonomous-vehicle research, favorable regulatory push for vehicle safety and high OEM demand. Europe is another key region where safety legislation, ADAS adoption, premium vehicle production and robust automotive supply-chains are driving LiDAR usage. In Asia-Pacific the pace of growth is perhaps most rapid, as China, Japan, South Korea and other countries increase EV and autonomous vehicle production, invest heavily in smart-mobility infrastructure and pursue domestic sensor ecosystems. Emerging regions such as Latin America, Middle East & Africa are starting from a lower base but hold long-term potential because as vehicle ecosystems mature there will be rising demand for advanced sensing and safety systems. Regional differences in vehicle segments, regulation, consumer acceptance of autonomy, cost sensitivity and local supply-chains will determine how quickly LiDAR sensors proliferate in each market.

Looking ahead the automotive LiDAR sensors market is poised for robust expansion, as vehicles become more autonomous, connected and software-heavy. Success in the market will hinge on delivering cost-effective LiDAR solutions that meet automotive reliability, packaging, power and performance demands. Partnerships between sensor manufacturers, automotive OEMs, software providers and infrastructure players will accelerate innovation and scale. As LiDAR technology becomes more mature and affordable, adoption will expand from high-end vehicles and autonomous prototypes into mainstream vehicle segments and commercial fleets. For companies participating in this ecosystem it will be essential to align product road-maps with vehicle autonomy targets, regional regulatory trajectories and modular system architectures that can be adapted across vehicle types and geographies.

FAQs

1. What role do LiDAR sensors play in modern vehicles?

LiDAR sensors provide high-resolution, accurate 3D mapping of a vehicle’s surroundings which supports object detection, obstacle avoidance, pedestrian recognition and environmental awareness. This capability is foundational for ADAS features and future autonomous driving.

2. What technological trends are shaping sensor adoption in vehicles?

Key trends include the shift from mechanical to solid-state LiDAR, miniaturisation and cost reduction, long-range sensing, sensor-fusion with radar and cameras, on-board processing, and integration into vehicle software and architectures that support connectivity and autonomy.

3. Which regions offer the strongest growth potential for LiDAR sensors in vehicles?

Asia-Pacific offers some of the strongest growth potential due to high vehicle production, increasing EV and autonomy adoption, and investment in smart-mobility infrastructure. North America and Europe remain important for advanced features and safety-driven adoption, while emerging markets provide long-term opportunities as vehicle features and infrastructure advance.

More Related Report

Categorieën

Read More

IntroductionThe temporary power cooling market serves industries and emergency situations where short-term cooling solutions are required to maintain operations, protect equipment, or ensure human comfort. Temporary power cooling systems are portable cooling units that operate independently or alongside temporary power sources such as generators. These systems are widely used during planned...

Polymer Market Overview: Trends, Growth Opportunities, Key Companies, and Future Outlook The Global Polymer Market is experiencing remarkable growth, driven by rising industrial demand, technological innovation, and expanding end-use applications. According to recent estimates, the Polymer Market size is projected to grow from USD 599.6 billion in 2025 to USD 972.4 billion by...

"Executive Summary Neurovascular Thrombectomy Devices Market Size and Share: Global Industry Snapshot The global neurovascular thrombectomy devices market size was valued at USD 3.00 billion in 2024 and is expected to reach USD 5.00 billion by 2032, at a CAGR of 6.60% during the forecast period. The market growth is largely driven by the rising...

Resumen ejecutivo : Tendencias del mercado de roca fosfórica : participación, tamaño y pronóstico futuro El tamaño del mercado global de roca fosfórica se valoró en USD 27,24 mil millones en 2024 y se proyecta que alcanzar los USD 46,45 mil millones para 2032, con una CAGR del 6,90 % durante el período de...

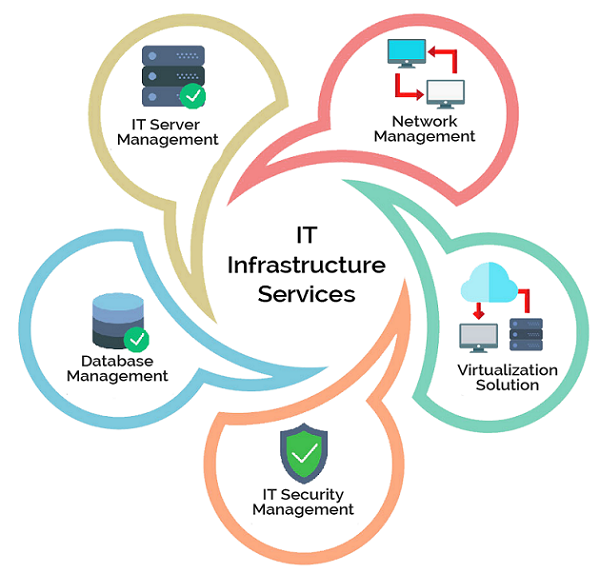

The global IT Infrastructure Services industry is the critical sector of the economy responsible for building, managing, and securing the digital foundation of the modern world. This industry is a vast and complex ecosystem of technology experts, engineers, and consultants who provide the essential services needed to keep the digital lights on for businesses, governments, and other...