All-Flash Array Market Shares, Demand, and Growth Trends 2032

Introduction

An All-Flash Array (AFA) is a data storage system that uses only flash memory (solid-state drives, or SSDs) rather than spinning hard disks. AFAs provide high input/output operations per second (IOPS), low latency, and greater energy efficiency compared to traditional disk-based or hybrid systems. The AFA market includes hardware, firmware, software (such as data management, deduplication, and compression), and integrated services, delivered to cloud providers, enterprises, hyperscalers, and data centers.

The importance of the AFA market lies in supporting modern digital workloads—artificial intelligence, real-time analytics, virtualization, high-performance databases, and large-scale cloud infrastructure. As data volumes explode, and demands for performance and responsiveness increase, AFAs become a core foundation for enterprise IT. They also help reduce operational costs through lower power, cooling, and maintenance overhead.

These projections underscore the rising adoption of high-performance storage, making AFA a strategic growth segment in the broader enterprise flash storage space. The enterprise flash storage market (which includes hybrid and all-flash) is also forecasted to grow at ~13.1% CAGR between 2024 and 2030.

Learn how the All-Flash Array (AFA) is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-all-flash-array-market

The Evolution

Historical Development

The storage industry’s shift to flash-based systems began with SSDs in server cache tiers and as accelerators within hybrid arrays. Initially, cost and endurance constraints limited adoption to performance-sensitive tiers. Over time, improvements in flash technology (3D NAND, better controllers, endurance) lowered cost per gigabyte and improved reliability.

The first pure flash arrays emerged around the early 2010s, combining SSDs with storage controller stacks, firmware, and software features (compression, dedupe, snapshots). Early adopters were high-end, latency-sensitive workloads—databases, virtualization, real-time analytics.

As economies of scale, component innovations, and software maturity advanced, AFAs migrated to mainstream workloads. Vendors refined flash management, wear leveling, error correction, and integration with storage virtualization and orchestration layers.

More recently, innovations such as NVMe over Fabrics (NVMe-oF), computational storage, persistent memory integration, adaptive data reduction, and cloud-native integration have pushed AFAs into more architectures and use cases.

Key Milestones & Shifts

-

Introduction of enterprise-grade SSDs with multi-level cell (MLC) and 3D NAND.

-

Integration of data services: deduplication, compression, thin provisioning, snapshots.

-

Adoption of NVMe and NVMe-oF to reduce latency across network fabrics.

-

Convergence with software-defined storage, converged infrastructure, and cloud orchestration.

-

Shift from AFA as “tier-0 / tier-1 accelerators” to becoming general-purpose primary storage in many enterprises.

-

Emergence of hyperscaler/AFA tailoring for large-scale data center deployment with disaggregated architectures.

-

Transition toward modular, scalable systems; use of custom flash modules alongside commodity SSDs for performance-cost balance.

These shifts reflect a move from niche, high-performance setups to broader adoption for mainstream storage workloads.

Market Trends

1. Broadening Workload Coverage

Enterprises are increasingly deploying AFAs beyond performance-sensitive tiers into general-purpose primary storage, replacing older hybrid systems.

2. NVMe & Fabric Accelerated Designs

NVMe over TCP, RoCE, or other fabrics is becoming standard, enabling low-latency access across distributed environments.

3. Consumption Models & Storage-as-a-Service

Subscription, pay-as-you-go, or storage-as-a-service models are growing, letting customers scale without large upfront CAPEX.

4. Software & Data Efficiency Features

Advanced compression, deduplication, real-time analytics, AI-based tiering, and predictive maintenance are built into modern AFA stacks.

5. Cloud Integration & Hybrid Architectures

AFAs are being integrated with cloud storage tiers, enabling tiering, replication, and disaster recovery across hybrid environments.

6. Edge & Distributed Storage

As edge computing grows, compact AFAs are being deployed closer to workloads to reduce latency and improve resilience.

7. Workload Convergence & Unified Storage

AFAs are converging with unified, file, object, and block storage to support a diverse set of workloads on a single platform.

Regional & Global Adoption Patterns

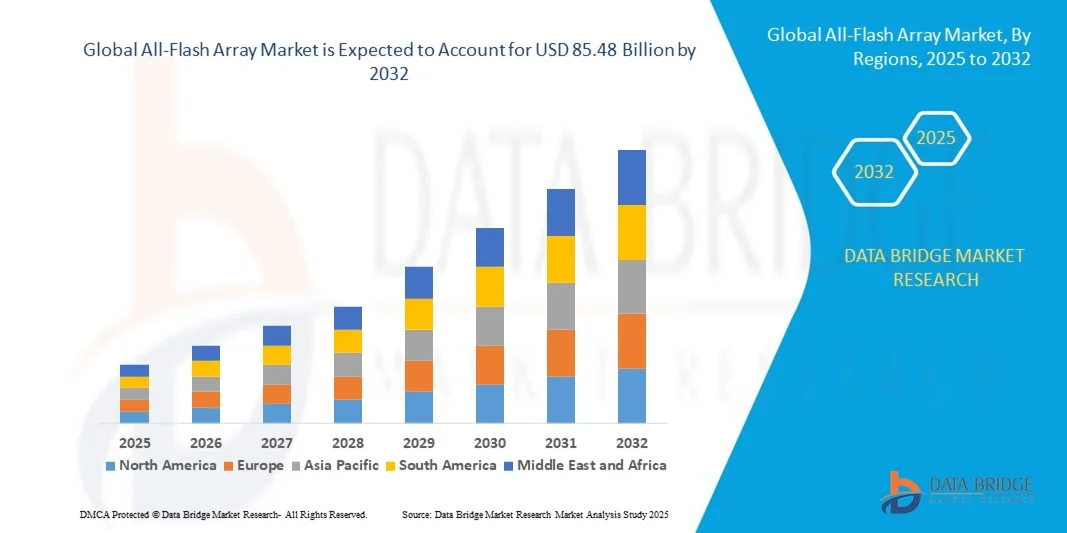

North America and Europe currently lead adoption due to large enterprise IT budgets, data center density, and advanced infrastructure. Asia-Pacific is fast adopting AFAs, especially in China, India, Japan, and Southeast Asia, driven by cloud providers, telcos, and digital transformation initiatives. Latin America, Middle East, and Africa are emerging adopters, often via cloud or regional cloud providers.

Challenges

1. Cost and Pricing Pressure

Flash media remains more expensive per TB compared to HDDs. While prices have dropped, customers still weigh cost vs. benefit in capacity-driven workloads.

2. Flash Endurance & Wear

Although modern SSDs are more durable, endurance constraints and wear leveling remain concerns for heavy-write workloads.

3. Data Reduction Tradeoffs

Deduplication and compression can introduce CPU overhead or latency, especially if not tightly integrated with the hardware.

4. Complexity of Integration

Integrating AFAs with existing storage, backup, data protection, and virtualization layers poses complexity and migration risk.

5. Vendor Lock-in Risks

Customers may be concerned about dependency on proprietary firmware or hardware. Interoperability and data portability are critical.

6. Ecosystem Fragmentation

Fragmented standards and interfaces (e.g., NVMe versions, fabric protocols) may slow cross-vendor compatibility.

7. Supply Chain & Flash Component Volatility

Flash memory supply constraints, pricing pressure, and technology discontinuities pose risks.

Risks include latency anomalies, firmware bugs, component obsolescence, vendor disruptions, and security vulnerabilities.

Market Scope

Segmentation by Storage Architecture / Access Pattern

-

Block Storage (the dominant AFA segment for databases, virtualization)

-

File Storage

-

Object Storage

In 2023, block storage led market share due to demand for structured performance workloads. GlobeNewswire+1

By Mounting / Flash Media Type

-

Custom Flash Modules (CFMs)

-

Standard SSDs / U.2 / U.3 SSDs

CFMs are often used in ultra-high-performance or hyperscale settings for optimization, while SSDs provide flexibility and cost efficiency.

By Enterprise Size / Deployment

-

Large Enterprises / Hyperscale

-

Small & Medium Enterprises (SMEs)

Large enterprises and cloud providers account for majority of revenue, but SMEs are increasingly adopting AFAs via managed services.

By Industry Vertical

-

IT / Telecom

-

Banking, Financial Services & Insurance (BFSI)

-

Healthcare

-

Government & Public Sector

-

Retail & E-commerce

-

Manufacturing

-

Media & Entertainment

BFSI is frequently cited as one of the largest adopters, due to high demands in transaction volume, real-time analytics, and data reliability.

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Market Size & Factors Driving Growth

- The global all-flash array market size was valued at USD 19.23 billion in 2024 and is projected to reach USD 85.48 billion by 2032, growing at a CAGR of 20.50% during the forecast period.

Other projections include:

-

From USD 14.59 billion in 2023 to USD 74.62 billion by 2032, at ~19.93% CAGR.

-

From USD 10.83 billion in 2023 to USD 52.42 billion by 2031, at ~24.04% CAGR.

-

DataIntelo estimates growth from USD 15.8 billion in 2023 to USD 50.2 billion by 2032, CAGR ~14.1%.Verified Market Research cites USD 10.83 billion in 2023, projected to USD 52.42 billion by 2031 (CAGR ~24%).

While these projections vary, they consistently suggest robust growth.

Key Drivers:

-

Explosion in Data Volumes & Real-Time Analytics Needs – AI, IoT, big data intensify performance needs.

-

Workload Consolidation & Virtualization – More workloads are consolidated onto fewer, faster storage arrays.

-

Digital Transformation & Cloud Adoption – Enterprises moving core systems to high-performance infrastructure.

-

Energy, Cooling & Operational Efficiency – Reduced power and maintenance costs compared to HDD or hybrid systems.

-

Improved Flash Technologies – Advancements in 3D NAND, controllers, firmware boost lifespan, density, cost.

-

Emergence of NVMe / NVMe-oF – Speeds over fabrics push performance capabilities.

-

Shift to Consumption Models – Storage-as-a-service, subscription models lower entry barriers.

Opportunities in Emerging Regions:

Asia-Pacific (especially China, India, Southeast Asia) is expected to see accelerated AFA adoption. Latin America, Middle East & Africa offer growth potential via cloud providers and modernization of enterprise storage.

Conclusion

The All-Flash Array market is set to experience sustained, high-growth expansion through 2035, driven by intensifying demand for high-performance, low-latency storage. Technology roadmaps, integration with software-defined infrastructure, cloud-native use cases, and consumption-based delivery models will further broaden adoption.

Success in this domain will require balancing performance, cost, reliability, and flexibility. Vendors that deliver robust data services, open ecosystems, scalability, and strong integration with emerging technologies (NVMe, edge, AI) will lead the next frontier of enterprise storage.

Given the trajectory, the AFA segment has the potential to transform data infrastructure across industries, becoming the backbone for high-throughput, mission-critical workloads.

FAQs

1. What is an All-Flash Array (AFA)?

An AFA is a storage system composed entirely of flash memory (SSD) hardware, without spinning disks, designed for high IOPS and low latency.

2. What is the expected market size in 2035?

It is projected at USD 132.2 billion by 2035, per one forecast.

3. What CAGR is projected?

A forecast CAGR of 15.4% from 2025 to 2035.

4. What were recent market values?

Estimates include USD 14.59 billion in 2023 (SNS Insider) or USD 10.83 billion in 2023 (Verified Market Research)

5. Which storage architecture leads?

Block storage remains dominant for structured, performance-sensitive workloads.

6. Which industries drive demand?

Key verticals include IT/Telecom, BFSI, healthcare, government, retail, and media. BFSI in particular drives demand for high-speed storage in transactional analytics.

7. What are major challenges?

Cost per TB, flash endurance, integration complexities, vendor lock-in, and supply chain volatility.

8. What technology trends are influencing growth?

NVMe over fabrics, software-defined storage, cloud integration, analytics-assisted data management, and flash module innovations.

9. Which region leads AFA deployment?

North America has been the leader, with Europe also strong; Asia-Pacific is the fastest-growing region.

10. How do vendors compete?

By differentiating firmware, data services, ecosystem integration, scalability, performance efficiency, and pricing/consumption models.

Browse More Reports:

Global Smart Shelf Management Market

Global Smoking Cessation and Nicotine De-Addiction Market

Global Social Determinants of Health (SDOH) Market

Global Sodium Bicarbonate Market

Global Solar Home Systems Market

Global Solar Photovoltaic (PV) Mounting Systems Market

Global Solid Phase Extraction Market

Global Spasticity Treatment Market

Global Specialty Meat Ingredients Market

Global Spend Analytics Market

Global Spinal Cord Stimulators Market

Global Spray Foam Insulation Market

Global Stability Improvers Market

Global Stainless Steel Lunchbox Market

Global Stasis Dermatitis Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com