Middle East and Africa Lithium Ion Battery Market Current Size, Status, and Future Projections 2032

Introduction

The Middle East & Africa (MEA) Lithium-Ion Battery Market pertains to the manufacture, deployment, and utilization of lithium-ion (Li-ion) battery technologies across sectors such as energy storage, electric mobility, grid systems, and portable electronics within the Middle Eastern and African regions. Lithium-ion batteries are rechargeable energy storage devices that use lithium ions moving between electrodes to store and release electrical energy.

This market holds increasing strategic importance due to efforts across MEA to diversify energy sources, enhance grid resilience, support renewable integration, and electrify transportation. Li-ion batteries are central to these agendas because of their high energy density, declining cost curves, and versatility across use cases.

Investments in utility-scale systems, off-grid solutions, and energy resiliency projects position the MEA Li-ion battery market for strong growth through 2035.

Learn how the Middle East & Africa (MEA) Lithium-Ion Battery Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-lithium-ion-battery-market

The Evolution

The MEA Li-ion battery sector has progressed through phases of nascent adoption, pilot projects, and increasing commercial deployment:

-

Early Stage (Pre-2015): Battery systems in MEA were mostly lead-acid or conventional chemistries. Li-ion technologies were limited to niche uses such as telecom backup, defense systems, or remote microgrids.

-

Initiation Phase (2015–2020): Declining global Li-ion costs and growth of renewable projects (especially solar) spurred pilot battery energy storage system (BESS) deployments in Gulf countries, South Africa, and North Africa.

-

Commercial Deployment (2021–2025): Larger grid-scale battery installations began in the UAE, Saudi Arabia, and South Africa, supporting peak shaving, frequency regulation, and solar smoothing. The region also saw growing interest in EV adoption and stationary storage solutions.

-

Scaling & Diversification (2025 onwards): The current stage is marked by scaling manufacturing, integration across sectors (mobility, grid, industrial), and development of supply chain hubs within the region.

Key milestones include the approval of large-scale BESS tenders by governments in the Gulf, integration of Li-ion systems in utility-scale solar projects, and partnerships with global battery technology providers.

Shifts have included moving from simple battery attachments toward hybrid systems (inverters + battery + software), and incorporating smart energy management platforms to optimize battery usage.

Market Trends

Multiple trends are driving the trajectory of the MEA Li-ion battery market:

1. Renewable Integration & Grid Stability

With solar and wind generation expansion in the Gulf and North Africa, battery systems are needed to manage intermittency and ensure grid stability. Li-ion is typically chosen for its high efficiency and fast response. For example, the Middle East BESS market (including Li-ion) is forecast to grow at 14.7% CAGR to 2033.

2. Utility-Scale Deployment Growth

Mega-scale battery projects, such as utility-scale storage co-located with solar farms, are being procured to provide energy arbitrage and backup power. The UAE BESS market alone is projected to grow from USD 324.1 million in 2023 to USD 3,073.5 million by 2030.

3. Electrification of Transportation

EV adoption is increasing in MEA, particularly in wealthier Gulf states. Li-ion battery demand is expected from passenger cars, buses, and two-wheelers.

4. Distributed and Behind-the-Meter Storage

Commercial, industrial, and residential sectors are adopting Li-ion systems for self-consumption, peak-shaving, and backup power.

5. Hybridization with Renewables

Battery + solar + inverter systems are being offered as turnkey packages, enabling microgrids and off-grid installations.

6. Local Assembly and Manufacturing Initiatives

Governments are exploring local battery assembly and cell manufacturing to reduce import dependency and generate industrial jobs.

7. Increasing Demand for Grid Resiliency and Energy Security

In regions prone to power outages, battery systems become critical infrastructure to ensure continuous operations.

Regional adoption shows concentration in Gulf Cooperation Council (GCC) states, South Africa, Egypt, and Kenya, with emerging growth in East and West Africa.

Challenges

The MEA Li-ion battery market must overcome several challenges:

-

High Capital Expenditure (CAPEX): Battery projects require substantial upfront investment, often limiting adoption to well-funded utilities or corporates.

-

Supply Chain Dependence: Most battery cell manufacturing is based in Asia; importing cells and modules incurs lead times, tariffs, and currency risks.

-

Limited Local Expertise & Ecosystem: Engineering, installation, maintenance, and battery recycling infrastructure are underdeveloped in many MEA countries.

-

Regulatory and Policy Barriers: Inconsistent regulatory frameworks across countries, lack of standardized mandates for energy storage, and uncertain incentives slow deployment.

-

Grid and Interconnection Constraints: Weak or aging grid infrastructure can limit the ability to integrate large battery systems.

-

Thermal and Environmental Challenges: High ambient temperatures, dust, and harsh environmental conditions demand robust battery thermal management systems, raising cost and reliability risks.

-

Degradation and Lifecycle Management: Long-term performance, degradation, and end-of-life battery recycling are critical but immature areas in the region.

Risks include volatility in raw material prices (lithium, nickel, cobalt), regulatory reversals, project delays, and safety and warranty concerns.

Market Scope

Segmentation by Battery Chemistry / Type:

-

Lithium Nickel Manganese Cobalt (NMC)

-

Lithium Iron Phosphate (LFP)

-

Lithium Nickel Cobalt Aluminum (NCA)

-

Others (e.g., Nickel Manganese Cobalt, hybrid cells)

LFP is gaining preference for stationary storage due to its safety, cycle life, and cost benefits. NMC/NCA may dominate mobility segments.

By Application:

-

Grid / Utility Scale Storage

-

Commercial & Industrial (C&I) Storage

-

Residential / Behind-the-Meter

-

Electric Vehicles & Transportation

-

Off-grid Microgrids & Remote Systems

Grid-scale and C&I segments account for the bulk of value today, with residential and EV segments expected to grow faster.

By End User / Industry:

-

Utilities & Power Companies

-

Renewable Energy Producers

-

Commercial & Industrial (Factories, Data Centers)

-

Residential Consumers

-

Transport & Mobility Operators

By Geography (within MEA):

-

Gulf Region (UAE, Saudi Arabia, Oman, Qatar, Bahrain, Kuwait)

-

North Africa (Egypt, Morocco, Algeria)

-

Sub-Saharan Africa (South Africa, Kenya, Nigeria)

-

Middle East non-GCC (Jordan, Lebanon, etc.)

GCC states currently lead deployment due to stronger capital availability, ambitious energy transition goals, and high solar potential.

Market Size and Factors Driving Growth

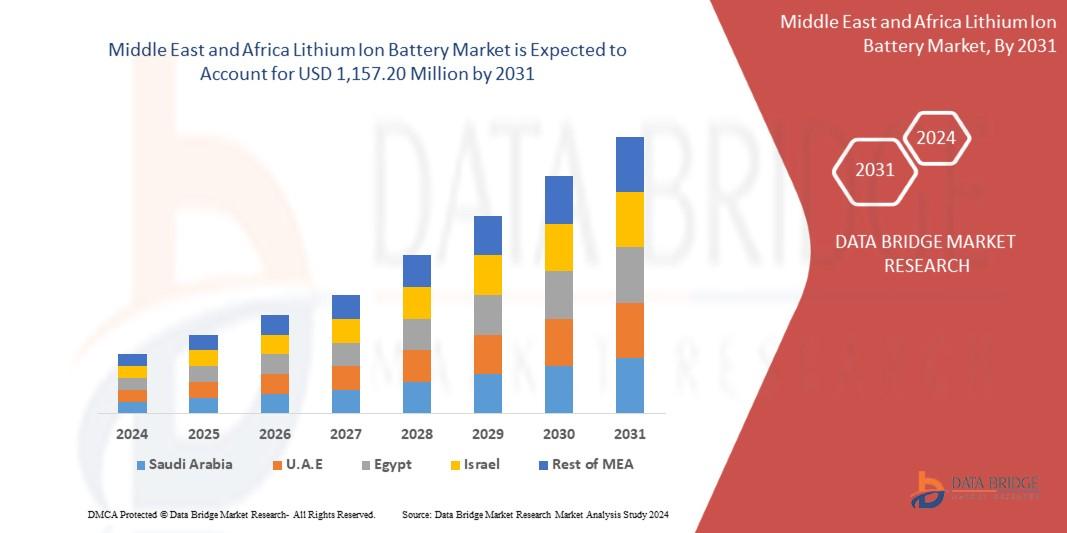

Middle East and Africa lithium ion battery market size was valued at USD 2.36 billion in 2024 and is projected to reach USD 6.98 billion by 2032, with a CAGR of 14.7% during the forecast period of 2025 to 2032.

Major growth drivers:

-

Renewable Energy Deployment

Massive solar projects in the Middle East and North Africa demand storage solutions to stabilize output and ensure dispatchable power. -

National Energy Transition Targets

Countries like UAE, Saudi Arabia, South Africa, and Egypt have set renewable capacity or net-zero objectives that inherently require storage. -

Falling Li-ion Battery Costs

Global cost declines and scale effects benefit MEA installations, making projects more financially viable. -

Electrification of Mobility

Rising EV adoption in GCC nations and public transport electrification initiatives will drive battery demand. -

Energy Resilience & Grid Modernization

Storing energy locally can reduce outages, delay grid upgrades, and improve reliability. -

Government Incentives and Capacity Auctions

Countries are adopting tender models for BESS, subsidies, or incentive schemes to lower barriers. -

Strategic Investments in Local Value Chains

Efforts to localize manufacturing, assembly, and recycling will improve supply security and cost competitiveness.

Opportunities abound especially in regions currently underserved—East Africa, Central Africa, and non-GCC Middle East—if capital, regulation, and infrastructure catch up.

Conclusion

The Middle East & Africa Lithium-Ion Battery Market is entering a phase of rapid growth, transformation, and strategic significance. While current deployment remains modest relative to global leaders, the confluence of renewable energy, electrification needs, and energy security imperatives creates a fertile ground for expansion through 2035.

To succeed, stakeholders must balance technological innovation, cost optimization, regulatory evolution, and ecosystem development. Players that invest in localized supply chains, adaptive system design for harsh climates, and project finance models tailored to emerging markets will lead in shaping MEA’s battery future.

Sustainability, integration, and resilience will be the pillars of this growth journey. The MEA Li-ion battery ecosystem has the potential to shift from being an importer of technology to a regional hub of deployment, innovation, and circular energy infrastructure.

FAQs

1. What is the MEA Lithium-Ion Battery Market?

It comprises all lithium-ion battery deployment and business across Middle East & Africa, including grid storage, EVs, residential, and industrial uses.

2. What is the size of Li-ion battery deployment in MEA today?

In 2024, the MEA grid-scale battery storage market—which is dominated by Li-ion technology—was worth USD 688.0 million.

3. What is the projected growth rate?

The broader MEA battery storage market is forecast at a 36% CAGR to 2030 (2024 baseline). Grand View Research

4. Which countries lead in deployment?

Gulf states (UAE, Saudi Arabia), South Africa, Egypt, and Kenya are leading in installations and policy support.

5. Which battery chemistries are preferred?

LFP is gaining traction for stationary storage due to safety and cycle life. NMC and NCA may remain in mobility segments.

6. What are the key challenges?

High CAPEX, supply chain dependence, regulatory fragmentation, thermal stress, and limited local skills/infrastructure.

7. What are major growth drivers?

Renewables integration, energy policy targets, cost reductions, EV demand, and grid resilience needs.

8. What markets segment the demand?

Major segments include grid/utility scale, commercial & industrial, residential, and transportation.

9. What is the opportunity in mobility?

EV adoption in GCC is rising, driving battery demand for passenger vehicles, buses, and two-/three-wheelers.

10. How can companies succeed in MEA?

By localizing assembly, forging government partnerships, optimizing battery systems for regional conditions, and participating in policy and tender frameworks.

Browse More Reports:

Global Release Agents in Meat Market

Global Reporter Tags Market

Global Residential Digital Faucets Market

Global Respiratory Diagnostics Market

Global Radio-Frequency Identification (RFID) Tags Market

Global RF Over Fiber Market

Global Rice Milk Market

Global Rice Starch in Animal Feed Market

Global RNA-Based Cardiac Therapeutics Market

Global Robotic Staplers Market

Global Rotomolding Products Market

Global Run of River Power Market

Global Sachet Packaging Machines Market

Global Salt Content Reduction Ingredients Market

Global Satellite Transponder Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com