The Resilient Core: Strategic Evolution of the Distribution Substation Market

As of February 2026, the global utility landscape is undergoing a decisive shift as energy providers move from static, one-way delivery to highly dynamic, bidirectional orchestration. At the center of this transformation is the Distribution Substation Market, which has evolved from a collection of passive transformers and switchgear into a sophisticated network of intelligent digital hubs. Driven by the explosive demand for high-capacity AI data centers, the rapid integration of residential electric vehicle charging, and the necessity to manage intermittent renewable flows, the distribution substation is now the indispensable "brain" of the modern grid. This year, the industry is characterized by two major movements: the large-scale deployment of digital-twin technology for predictive maintenance and the shift toward modular, factory-assembled units that can be deployed in weeks rather than months.

The Rise of Digital and Autonomous Substations

A defining hallmark of 2026 is the successful transition of digital substations from niche pilot projects to the mainstream standard. By replacing traditional copper control wiring with fiber-optic process buses and IEC 61850-compliant communication protocols, utilities are slashing installation costs by nearly seventy percent. These digital systems allow for real-time telemetry and autonomous fault isolation, which is vital as grid complexity increases.

For facility managers and utility operators, this digital pivot is a financial game-changer. Modern substations now feature "edge-computing" capabilities that process data locally, allowing the system to make split-second decisions to prevent cascading outages. This year, we are seeing the first widespread use of autonomous voltage regulation, where the substation automatically adjusts its output based on real-time demand from neighborhood microgrids and rooftop solar clusters. This level of orchestration ensures that even with the massive addition of variable renewable energy, the final delivery remains stable and reliable.

The AI Demand Shock and Modular Infrastructure

In 2026, the unprecedented growth of Artificial Intelligence has created a unique secondary market for specialized substation infrastructure. Hyperscale data centers require immense, dedicated power capacities—often between 100 and 500 megawatts—that traditional distribution networks were never designed to handle. This "AI demand shock" has forced a move toward modular and scalable substation designs.

These modular units are pre-engineered, factory-tested, and containerized, allowing they to be shipped and commissioned with a seventy percent reduction in onsite construction time. This year, this trend is proving vital for data center developers who are racing to bring new capacity online. By using "plug-and-play" substation modules, these developers can bypass the lengthy permitting and construction delays associated with traditional civil engineering projects, ensuring their AI clusters have the power they need exactly when they need it.

Sustainability and the SF6-Free Revolution

As nations move toward strict "Net Zero" mandates in 2026, the industry is also confronting its own environmental footprint. For decades, sulfur hexafluoride (SF6) was the industry standard for insulation due to its excellent electrical properties, despite being a potent greenhouse gas. In 2026, the market has pivoted decisively toward SF6-free alternatives.

Leading manufacturers are now deploying vacuum-interrupter technology and clean-air insulation for medium-voltage applications. This shift is not only driven by environmental regulation but also by the long-term operational benefits of "green" substations, which require less specialized maintenance and have lower decommissioning costs. In Europe and North America, these eco-friendly substations are winning the majority of new utility contracts as providers strive to meet aggressive decarbonization goals without sacrificing grid performance.

Regional Industrialization and Future Outlook

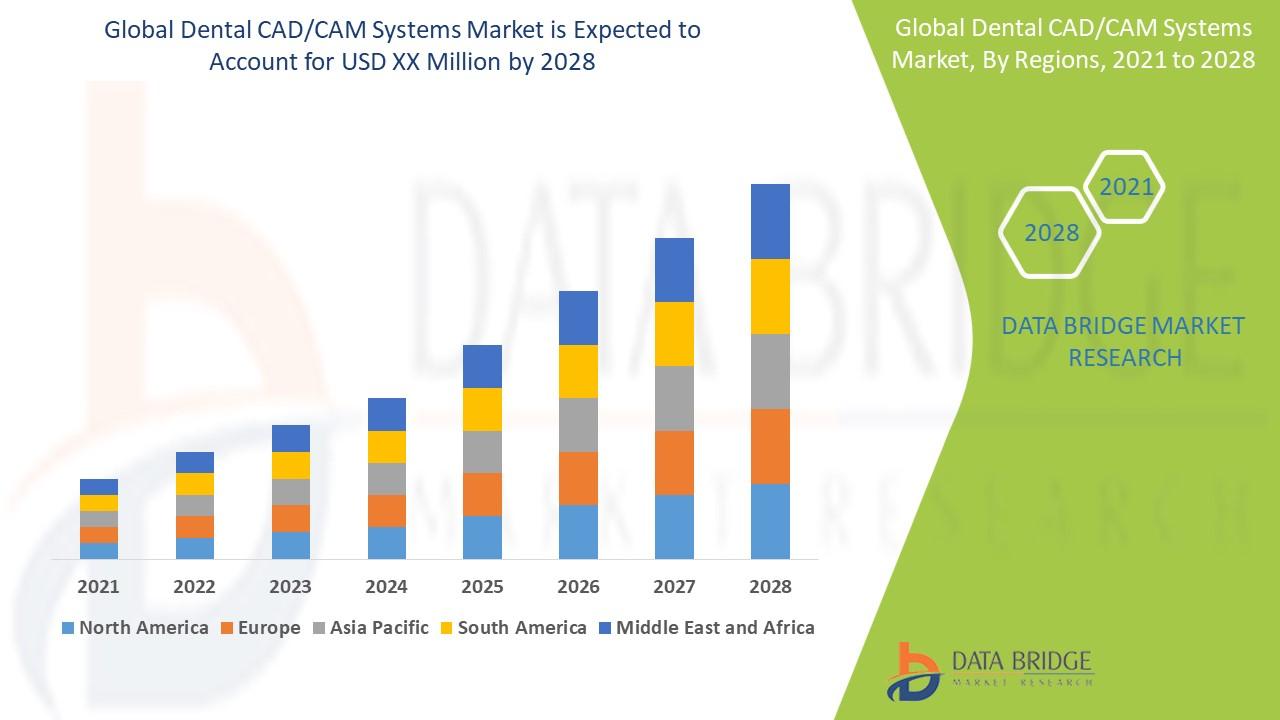

Geopolitically, 2026 is marked by the expansion of infrastructure capacity in the Asia-Pacific region and a significant "reshoring" of power equipment manufacturing in the United States and India. While Asia-Pacific remains the largest and fastest-growing market due to massive urbanization and rural electrification, the U.S. has solidified its role as a leader in grid-resilience technology, supported by billions of dollars in federal grid-modernization grants.

In developed economies, the growth is centered on the "Retrofit Revolution," where aging substations built in the 1970s and 80s are being stripped of their analog components and rebuilt with smart sensors and cyber-hardened communication ports. As we move deeper into the decade, the distribution substation will continue to evolve, moving beyond its role as a simple voltage converter to become the central intelligence hub for a decarbonized, decentralized, and digital energy future.

Frequently Asked Questions

What is the main difference between a traditional and a digital substation in 2026? The primary difference lies in how data is transmitted. Traditional substations rely on thousands of meters of copper wiring to send analog signals between equipment. Digital substations replace this with a fiber-optic network (process bus) and Intelligent Electronic Devices (IEDs), which allow for faster data transmission, real-time monitoring, and significantly lower installation and maintenance costs.

Why is modular substation design becoming so popular this year? Modular design allows for rapid deployment. Because the units are pre-assembled and tested in a factory, they can be installed on-site in a fraction of the time required for traditional "stick-built" substations. This is especially critical for fast-growing sectors like AI data centers and EV charging hubs that need to scale their power capacity quickly.

How is the market addressing the environmental impact of substation insulation? The industry is moving away from SF6 gas, which has a high global warming potential, toward "clean air" and solid insulation technologies. These SF6-free solutions are becoming the requirement in many regions to meet 2026 environmental standards, providing the same high-voltage protection without the long-term ecological risks.

More Trending Reports on Energy & Power by Market Research Future

Gas Water Tube Industrial Boiler Market Size

Gasifier Balance Of Plant Component Market Size