The Rise of Smart and Sustainable Automotive Aftermarkets

Introduction

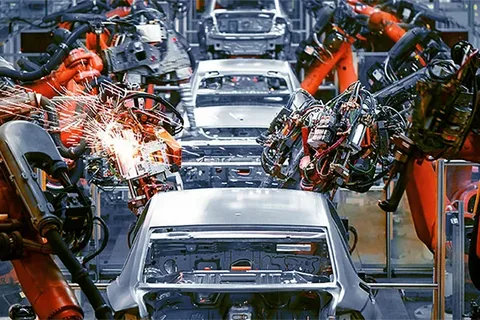

The US Automotive Aftermarket continues to demonstrate robust growth, driven by the nation’s expanding vehicle population, aging car fleet, and the rising demand for customization and maintenance solutions. As vehicles on American roads become older and more technologically advanced, the need for repair, replacement, and performance enhancement products is growing significantly. The aftermarket encompasses a wide range of components, including tires, batteries, lubricants, filters, accessories, and diagnostic tools, making it an essential part of the country’s automotive ecosystem. With consumers prioritizing cost-effective maintenance and vehicle longevity, the US Automotive Aftermarket is evolving through digitalization, e-commerce integration, and innovation in parts manufacturing and distribution.

Market Drivers

One of the key drivers of the US Automotive Aftermarket is the steadily increasing average age of vehicles, which now exceeds 12 years. Older vehicles naturally require more frequent repairs and replacement parts, boosting aftermarket demand. The strong presence of do-it-yourself (DIY) culture among American vehicle owners further supports growth, as more consumers opt to perform maintenance and customization tasks independently. Technological innovation in diagnostic tools and mobile repair services is also improving convenience and accessibility. Additionally, the rise of e-commerce platforms has transformed how consumers purchase automotive parts and accessories, offering competitive pricing, product variety, and doorstep delivery. Fleet operators and logistics companies are increasingly relying on aftermarket services for cost control and uptime optimization, adding another growth layer.

Market Challenges

Despite a strong outlook, the US Automotive Aftermarket faces several challenges. The increasing complexity of modern vehicles, particularly electric and hybrid models, requires specialized tools and training that not all independent workshops possess. Counterfeit and low-quality spare parts remain a concern, affecting both performance and safety standards. Supply chain disruptions and raw material price fluctuations can impact part availability and pricing. Additionally, the rise of electric vehicles, which have fewer moving parts and lower maintenance needs, may gradually shift demand away from traditional components like oil filters and exhaust systems. Labor shortages in skilled automotive technicians also pose a challenge to maintaining service quality across the aftermarket sector.

Market Opportunities

The shift toward digitalization and sustainable mobility presents new opportunities in the US Automotive Aftermarket. The growing adoption of connected vehicle technologies and telematics enables predictive maintenance, allowing service providers to offer timely repairs before failures occur. Electric and hybrid vehicles are generating demand for specialized components such as battery management systems, charging equipment, and regenerative braking parts. The trend toward eco-friendly materials and remanufactured components is expanding as consumers and businesses become more environmentally conscious. Moreover, the integration of augmented reality (AR) tools for remote diagnostics and virtual repair guidance can revolutionize customer service. Subscription-based maintenance models and partnerships with automakers for authorized aftermarket support are also gaining traction.

Regional Insights

Regionally, the US Automotive Aftermarket is strongest in states with high vehicle ownership and longer commute distances, such as California, Texas, and Florida. The Midwest, known for its strong automotive manufacturing base, also contributes significantly to the aftermarket due to a high concentration of vehicles and repair facilities. The Northeast region, characterized by older vehicle fleets and seasonal weather changes, witnesses high demand for tires, batteries, and maintenance parts. The South and West regions are seeing growing interest in customization, off-road accessories, and performance enhancement products, driven by lifestyle and recreational vehicle usage. Urban centers are rapidly adopting digital and mobile repair platforms, while rural areas continue to rely on local service providers.

Future Outlook

The future of the US Automotive Aftermarket looks promising, with strong potential for digital growth and service innovation. By 2032, data-driven analytics, artificial intelligence, and e-commerce will dominate aftermarket operations, streamlining supply chains and improving inventory management. The rise of electric vehicles will not diminish the sector but rather reshape it, introducing new product categories and service requirements. Autonomous and connected cars will demand sophisticated sensors, software updates, and cybersecurity services, opening fresh revenue streams. Sustainability initiatives, such as recycling and circular economy practices, will become core priorities for manufacturers. As vehicle technology advances, collaboration between OEMs and aftermarket suppliers will ensure compatibility and performance, strengthening consumer trust.

Conclusion

In conclusion, the US Automotive Aftermarket stands as a vital pillar of the automotive economy, balancing tradition and innovation. While evolving vehicle technology and regulatory changes present challenges, the sector’s adaptability ensures continued growth. With the increasing integration of digital tools, sustainable practices, and connected vehicle data, the aftermarket is entering a transformative phase where convenience, customization, and quality define competitiveness. As consumers continue to seek cost-effective and efficient vehicle maintenance, the US Automotive Aftermarket is poised to remain indispensable to the nation’s mobility infrastructure and economic stability.